While excellent newsletters on specific themes within public policy already exist, this thought letter is about frameworks, mental models, and key ideas that will hopefully help you think about any public policy problem in imaginative ways. Audio narration by Ad-Auris. If this post was forwarded to you and you liked it, consider subscribing. It’s free.

Global Policy Watch #1: The Many Transitions In ChinaGlobal issues and their implications for India— RSJ In a few editions in the past, we have alluded to structural challenges in the Chinese economy and the window of opportunity that it presents India. I thought it would be useful to take a more comprehensive view of this. China reported a GDP growth of 0.4 per cent in the quarter that ended in June 2022. China's National Bureau of Statistics (NBS) isn’t known for its allegiance to truth. It is safe to assume the real GDP would have shrunk in the quarter. The daft ‘zero Covid’ policy led to total lockdowns in major cities during the quarter. The government crackdown on the real estate sector has meant that investment in the sector fell sharply. These contributed to the slowdown. Two other data points are interesting to note. The unemployment rate among the youth aged between 16-24 was at an all-time high of about 20 per cent. Also, retail sales continued to be weak at about 2.7 per cent, much below the 5 per cent forecast. Domestic consumption, the great desire of Chinese policymakers, remained sluggish. The spokesperson for the NBS put up a brave face while spinning these numbers as short-term bumps on the road. He raised the possibility of global stagflation and its negative impact on China to possibly justify weak numbers in the future. But is this slowdown just a blip in the impressive rise of China in the past three decades? I’m not sure. There are three transitions underway in China right now. It is difficult for nations to pull off any one of these in normal times. To attempt three simultaneously is ambitious. It is most likely to fail. Anyway, back to these transitions.

In my (very broad) view, Xi has concluded that China might have peaked in economic growth. You start talking about redistribution and ‘dividing it properly’ when you know the pie won’t grow at the same rate as it was earlier. Importantly, I also suspect this is the reason why Xi is acting like a bully in the neighbourhood. If you know you have hit the peak of your geopolitical and geoeconomic leverage, you will be foolish to let the moment pass without maximising your gains. Some might argue furnishing other economic data that this ‘peaking’ theory isn’t true. China is still a global manufacturing engine. Its trade surplus has ballooned in the past year suggesting the world is hungrier for its goods. And so on. There’s this insightful column by Michael Pettis in FT that I will quote, which puts in perspective the record trade surpluses that China has been notching up in recent months while making these three transitions together. Pettis writes:

For India, all of this is a golden opportunity. China will remain busy with these transitions that it has wrought upon itself. The jury is still out on whether it will have a soft landing on them. Global businesses that started seeking more resilient and cost-effective alternatives to China during COVID-19, are now convinced that they must employ a ‘China + 1’ model to safeguard their long-term interests. There are only that many economies that have the labour pool, capital and a business environment that can take advantage of this shift away from China, however gradual. To me, it might be faster than what we all anticipate. And it will pass India by if it doesn’t stay alert to its possibilities. There is a high likelihood of a golden decade ahead for MSMEs in India if it plays its cards right. A long overdue factor market reforms (possible at the state level), kickstarting a government capex cycle that will instil confidence in the private sector to follow suit, not overdoing aatmanirbhar Bharat beyond the rhetoric and remaining an open and liberal democracy that convinces others that it will have sufficient checks and balances to not lose its way. These are the basic block and tackle moves to capitalise on the opportunity. Because the only lesson to learn from a possible China misstep is that overdetermined leadership and top-down economic thinking eventually fail. Course Advertisement: The Sept 2022 intake of Takshashila’s Graduate Certificate in Public Policy programme ends soon! Visit this link to apply.India Policy Watch #1: A Potent CocktailInsights on burning policy issues in India— Pranay Kotasthane The ongoing political saga in Delhi over a new (now suspended) excise policy is a heady cocktail for policy analysts. The cocktail’s components include a tussle over alcohol licenses, Maximum Retail Price (MRP), privatisation, regulation, allegations of corruption, rent-seeking, and political contestation. The political motivations behind the current actions are quite clear. But it might be useful to look at the under-discussed policy aspects of the debate. Useful, because it’s not the last time we have seen a stand-off on alcohol policy. The underlying motivation for the Delhi Excise Policy 2021-22 is to increase government revenue. Although we know that the best way to do that is lower the tax rate and broaden the base, India’s poor economic performance over the last decade has made it politically risky to bring additional people under the tax net. Hence, states are opting for the easier—and counterproductive—option instead: raise tax rates and increase non-tax revenue. With the GST taking away the power to raise tax rates on most items unilaterally, state governments are exploring other options. One lucrative option is liquor excise. The Indian State heavily regulates the production, sale, and consumption of alcohol. Streamlining the licensing policies for the production and sale of alcohol can generate non-tax revenue, while higher overboard consumption can result in an increase in tax revenue (excise duty). One reform, two revenue handles. This is why the Aam Aadmi Party (AAP) governments in Delhi and Punjab have set their eyes on this sector. Moreover, raising the fees on government-provided private goods doesn’t fit its existing political persona. To be fair, the Delhi Excise Policy 2021-22 is fairly progressive. It states that the policy's objectives are to augment the state excise duty revenue, simplify liquor pricing, prevent duty evasion, and transform the liquor trade commensurate with Delhi’s position as a city of global importance. To achieve these objectives, the policy aims to award new licenses for alcohol sale, dividing the city into 32 zones, with a fixed number of shops allowed per zone. It aims to end government-run booze shops, distributing those licenses to private players instead. To foster competition, it allows shops to offer discounts below the Maximum Retail Price (MRP), permits shops to stay open till 3 am, and authorises bars to serve alcohol in licensed open spaces. A report in the Business Standard captured the view of a craft beer brand as follows:

There were quite a few initial hiccups. Some dealers started giving deep discounts to capture the market. That led the government to change the no-MRP policy to a “discount only up to 25% of MRP” policy. After that, retailers started offering “buy one bottle, get another free”. And hence, big dealers could attract more customers, while the smaller ones were finding it difficult to compete. Some licenses didn’t attract any buyers at all. These seem to be transient-state shocks. The steady-state promised to be much better. Alas. Reforming a tightly regulated policy area in which powerful rent-seekers have flourished for decades is not easy. The old status quo has powerful defenders. Like many other reforms, the benefits are widely dispersed while the costs are concentrated. And so, many existing licensees have ganged up on the government. We can be sure that some of these licensees also have political connections, which they have used to oppose the policy. There is also the additional issue specific to alcohol — any policy that is seen to liberalise its sale becomes an easy target for conservative moralisers. Further, the Delhi government made a mistake by pausing the policy implementation amidst the criticism. Then came the political pushback. Despite the government’s revenue increasing by 27 per cent after the policy was put in place, some notional revenue loss of the “2G spectrum allocation” vintage has surfaced. There are also charges of favouritism and corruption in the allocation of new licenses, an issue so sensational that it requires the combined might of the Central Bureau of Investigation (CBI) and the Enforcement Directorate. (Sarcasm is intended.) Many state governments must be eying this Delhi experiment with excise policy reform. Moreover, this case illustrates the difficulty in reforming sub-optimal licensing arrangements. As for the Delhi government, are they reaping what they sowed in the name of anti-corruption?

Global Policy Watch #2: Xi Jinping’s ThoughtsGlobal issues and their implications for India— RSJ Talking of China (and I’m intruding into Pranay’s area of expertise), I came across this wonderful blog, globalinequality by Branko Milanovic. In his latest post, he writes about what he learnt from reading a translated version of the book, ' Anecdotes and Sayings of Xi Jinping’. Milanovic writes:

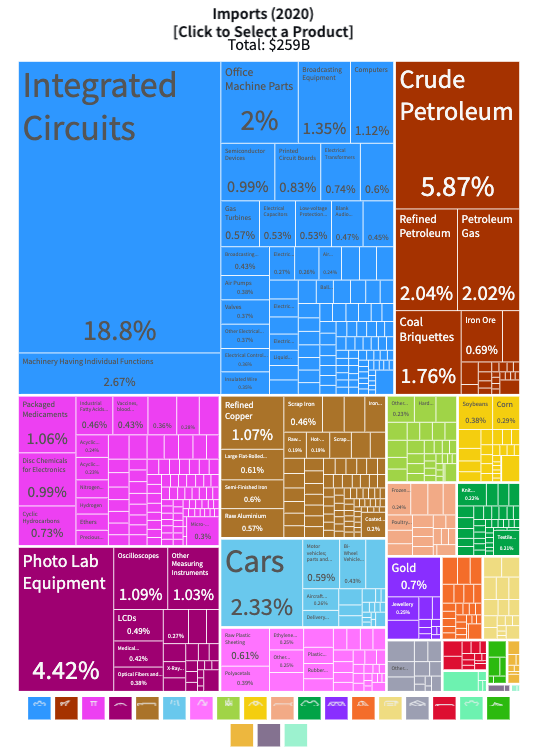

This is, to put it mildly, a brilliant summary of the ideological battle Xi has picked up and his odds of winning it. I tend to agree with its conclusion. India Policy Watch #2: Value Addition, Not Import SubstitutionInsights on burning policy issues in India— Pranay Kotasthane “Import Substitution” is still in vogue. One would have thought that the unsuccessful pursuit of this goal since independence would’ve discredited it. That doesn’t seem to be the case. Every few weeks, we come across policies targeting import substitution, implicitly if not explicitly. Just a few days back came the rumour that the government plans to ban Chinese phones priced under Rs 12,000 in order to give a leg up to domestic champions. Thankfully, unnamed sources in the government have denied this story for now. Even so, import tariff hikes and industrial policies continue to chase the illusory target of import substitution. Some policies for display fabs and drones explicitly mention import substitution as the target. Of late, this idea has morphed into targets for maximising value addition per unit of exports. Now, readers of this newsletter know what we think of this idea. In edition #161, we had warned that Atmanirbhar Bharat is approaching a wrong turn. We have also cautioned against the proliferation of Production Linked Incentives (PLIs) beyond a few critical sectors. I will make the case against import substitution in this edition using another example. Look at the chart below, which shows the import profile of a country for the year 2020. This country’s largest import by value is Integrated Circuits (chips) at 18.8%. The total import bill is $259 billion. Can you guess the country?

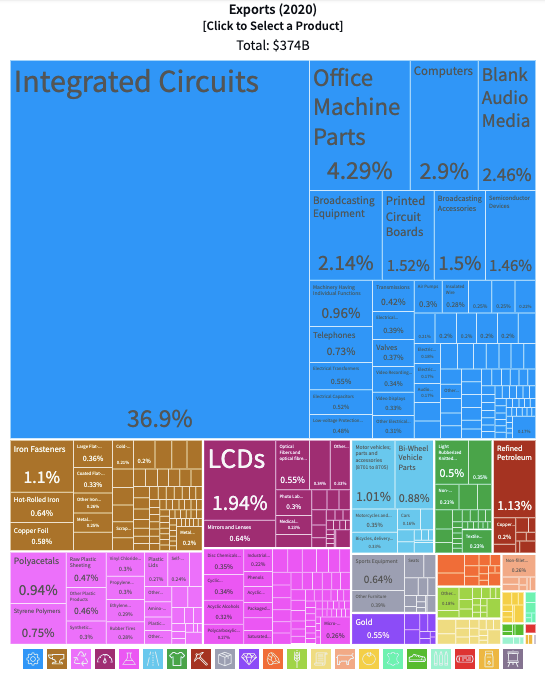

If you need a hint, here’s one: as exports rise, imports also rise. The world’s top two exporters are China and the US. And the world’s top two importers are also the US and China. The answer is neither the US nor China. India can be ruled out because we know that our biggest import is crude oil. Here’s another hint. Look at this country’s export profile for the same year. Its biggest export is again integrated circuits, at 36.9% out of a total exported value of $374 billion.

Do you have an answer now? The right answer might surprise you. This is the typical year-wise trade profile of a country that is acclaimed as the world’s semiconductor superpower: Taiwan! We forget that despite its unmatched prowess in contracted chip manufacturing, Taiwan is not even close to being self-sufficient. Some Taiwanese companies import chips, do value addition through packaging and testing, and then export the final commodity. A portion of the imported chips goes into the machines that are used to manufacture chips by the famed Taiwanese chip foundries. The fundamental message is that imports are critical to exports, even in sophisticated economies. PLI scheme began with the aim of promoting India’s exports. But my sense is that import substitution has displaced exports as the primary goal. How else does one explain the simultaneous increase in import tariffs and a phased manufacturing programme (PMP) that aims to increase tariffs on imported components? Atmanirbhar Bharat needs to return to its goal of creating competitive manufacturing capabilities in India by allowing companies to start, grow, and close with considerably less bureaucratic friction. Shielding domestic component makers from international competition on the one hand, and subsidising end-equipment manufacturers on the other will end up helping neither. Equipment manufacturers will merely make expensive, poor-quality products. Some others will use the production subsidies to import components at higher prices, with no net benefit to them or the consumers. As RSJ writes in the first section, this decade is India’s to lose. Imports aren’t evil. Target value maximisation, not import substitution. Counterproductive policies targeting import substitution won’t help. HomeWorkReading and listening recommendations on public policy matters

If you liked this post from Anticipating The Unintended, please spread the word. :) Our top 5 editions thus far: | |||||||||||||||||||||||||||||||||||||||||||||