Dear Reader,

JC Parets has been called “The King of Technicals” by Fox Business…

The CMT Association called him “one of the most widely read market commentators of this generation.”

And Business Insider says JC is “Among the top financial people you have to follow…”

He’s predicted market moves with near-perfect precision — including the 2008 crash…

When he warned his clients just days before the market plummeted…

He also told his clients to get OUT of stocks in early 2020, at the exact peak before they dropped 30% in a matter of days...

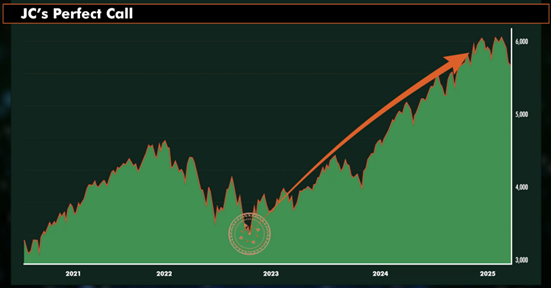

And he even called the exact bottom of the market on October 14th 2022, the precise moment before stocks rallied!

Now, he’s warning that a powerful market signal — one that’s preceded every crash for 50 years — will appear again on one specific date in the near future.

But before it does…

JC says we’re entering a short but explosive profit window — possibly the last of this decade.

Meaning RIGHT NOW could be your last chance to make money in stocks!

Click here to see his full prediction before this explosive profit window closes.

Regards,

Ryan McGrath

Co-Publisher, TrendLabs

3 Smart Defensive Stocks for an Uneasy Market

Written by Chris Markoch. Published 11/18/2025.

Key Points

- Despite new market highs, recession risks remain elevated due to weakening consumer credit and signs of job market stress.

- Procter & Gamble and Johnson & Johnson offer stable dividends, strong balance sheets, and catalysts that could provide upside in a downturn.

- A rotation away from AI and into Dow components could make the DIA ETF a compelling defensive play for 2025.

At one point in early November, the Dow Jones Industrial Average (DJIA) briefly topped 48,000 for the first time ever. At different times in 2025, the NASDAQ and S&P 500 have posted new all-time highs (ATHs). Despite sharp price swings, it has been a strong year for stocks.

Yet many economists, analysts and investors remain uneasy. The market appears priced for perfection, while recession risks remain largely unpriced.

Now That the Shutdown Is Over, Here's Where Attention Is Shifting (Ad)

Get the Signals People Wish They Saw Sooner

Market Maven Insights tracks under-the-radar small-cap names and sector momentum in real time—so you're not always reacting late.

Even with broad gains, skepticism persists. The Magnificent 7 trade may have cooled off, but the market continues to be driven by a narrow group of names, mostly tied to the AI boom.

The K-Shaped Economy Concern

Current economic commentary focuses on a K-shaped recovery. Higher-income consumers are navigating inflation of around 3%—still above the Federal Reserve's informal 2% target but manageable for affluent households.

Lower-income consumers, however, have been under pressure for several years. Rising credit defaults, delinquent auto loans and a recent uptick in foreclosures suggest the situation may be worsening. The labor market, previously the economy's strongest pillar, is also beginning to show signs of strain.

JPMorgan Chase & Co. (NYSE: JPM) recently lowered its estimate of recession probability from 60% to 40% after the recent de-escalation of trade tensions. That still represents a material risk.

Market Breadth Remains Narrow as Investors Chase Mega-Caps

Recent data from Charles Schwab shows the percentage of S&P 500, NASDAQ and Russell 2000 stocks trading above their 200-day moving average was slightly above 50%. That's historically low market breadth and adds to investors' concerns.

This isn't a redux of 2021, when investors piled into unprofitable SPACs in hopes of quick windfalls. Today's froth is concentrated in mega-cap names that generally have sizable cash reserves. Still, many investors feel several of these stocks are overvalued.

So what's an investor to do? Here are three investments that offer the potential for asymmetric returns in an uneasy market.

Procter & Gamble Has More Than a Dividend to Like

Procter & Gamble Co. (NYSE: PG) is a member of the exclusive Dividend Kings, having raised its dividend for at least 50 consecutive years—70 years in PG's case—making it a staple for many income-focused portfolios.

The 2.8% dividend yield looks more attractive if interest rates decline. Analysts' consensus $171.53 price target implies roughly 17% upside for the stock.

It remains unclear how PG's proposed acquisition of Kenvue (NYSE: KVUE) would affect near-term earnings. If the deal proceeds and the Tylenol controversy fades, the first year could see modest EPS dilution.

Over time, however, cost synergies between the companies would likely translate that dilution into an EPS benefit.

Johnson & Johnson Doubles Down on Medtech and Oncology Growth

Next is Johnson & Johnson (NYSE: JNJ), which spun off Kenvue in 2023 to focus on medtech and pharmaceuticals.

Its recent $3.5 billion acquisition of Halda Therapeutics illustrates that strategy.

The all-cash deal gives JNJ access to Halda's HLD-0915 clinical-stage drug candidate, a once-daily oral prostate cancer treatment that has received fast-track designation from the U.S. Food and Drug Administration (FDA).

This should be a meaningful addition to JNJ's oncology pipeline and could make the stock more attractive to growth-oriented investors.

The DIA ETF Could Benefit From a Flight to Safety

Over the past five years, many investors embraced a passive "SPY and chill" approach, buying the SPDR S&P 500 ETF Trust (NYSEARCA: SPY).

SPY may still be a reasonable choice, but with potential AI-driven exuberance creating concentration risk, it could be timely to consider the SPDR Dow Jones Industrial Average ETF Trust (NYSEARCA: DIA).

If fears of an AI bubble intensify, investors are likely to rotate into the Dow 30's more diversified, blue-chip names—making DIA a solid asymmetric play to capture that rotation.

As of this writing, DIA has about 37% institutional ownership, yet it has seen net buying in seven of the last eight quarters. That suggests institutions may be quietly building a hedge against a potential slowdown in the tech trade.

This email message is a sponsored message from Trend Labs, a third-party advertiser of Earnings360 and MarketBeat.

If you need assistance with your subscription, don't hesitate to email our U.S. based support team at contact@marketbeat.com.

If you no longer wish to receive email from Earnings360, you can unsubscribe.

Copyright 2006-2025 MarketBeat Media, LLC. All rights reserved.

345 N Reid Place, Sixth Floor, Sioux Falls, South Dakota 57103-7078. USA..