While excellent newsletters on specific themes within public policy already exist, this thought letter is about frameworks, mental models, and key ideas that will hopefully help you think about any public policy problem in imaginative ways. If this post was forwarded to you and you liked it, consider subscribing. It’s free. #234 Perfect is the Enemy of GoodCredit and Consumption Convolutions, Regulations on Substances of Human Origin, a Book Announcement, and Techno-evangelismIndia Policy Watch #1: A Splash Of Cold WaterReflections on current policy issues— RSJOne of the underreported stories of the Indian economy post-Covid is the strong consumption demand, which is somewhat at odds with slow capital formation, moderately high inflation, and an increasing interest rate cycle during this period. One possible answer to this is the strong retail credit offtake, which has been driven by a plethora of shadow banks (NBFCs in Indian parlance) and fintechs that have made the process of securing a small ticket (less than ₹50,000) unsecured loan extremely convenient. This segment has been growing at about 25 per cent, almost twice the rate of the remaining ‘less risky’ segments where the loans are secured by collateral like a house, car or gold for over a year. Now, this is somewhat unusual. More so, when you consider the data that of the total borrowers who have availed loans below ₹50,000, about half have four such loans. Now, unsecured personal loans are largely consumption-driven, where the end use of the funds is somewhat opaque to the lenders. Simply put, this data tells us that many customers are either living beyond their means or using these short-term loans to fund their long-term secured loans (like home or car loans) because they don’t want to default on them. One way to look at this is to consider the share of unsecured loans to the total loan portfolio of the banking system at just below 10 per cent and not be too concerned about a short-term growth spurt in this segment. After all, this easy availability of credit is one of the contributing factors to the moderately strong GDP growth numbers. Or the other way to view this is to ask why are people willing to take unsecured loans at significantly higher interest rates in the current environment? Is there a bubble building up here? I mean, the easiest thing in the world is to lend money to people without collateral. All the risk is upon you. The real business of unsecured lending isn’t disbursing loans at lightning-quick speed (which many a fintech think is a virtue) but to make sure you collect the money when the EMIs are due. The easier you make the process of availing a loan (all those ads of personal loans in less than 30 seconds), the more you attract customers who shouldn’t be getting these loans in the first place. There’s a moral hazard built in there. The RBI has been flagging the risks of the rapid growth in unsecured loans over the past couple of quarters. These have been quite explicit and specific. The RBI governor made this point in his October monetary policy review speech. Though it was done in the usual anodyne style of a regulator:

There were good reasons for this note of caution. Transunion CIBIL, the largest credit bureau in India that tracks credit data across banks, had this to say in their latest report for Q2, FY 23-24:

On Friday this week, the RBI acted by raising the risk weight of Banks and shadow banks on exposure to unsecured credit, credit card receivables and other shadow banks by about 25 per cent. This would mean lenders will have to set aside ₹25 more capital than before for every ₹100 they lend in these segments than in the past. Therefore, their risk-adjusted Return on Capital will fall, and they will either live with lower margins than before, or they will make these loans more expensive to the borrowers to maintain margin parity. It is almost certain lenders will choose to make the loans dearer for customers than take a hit on their margins, which in turn should mean a slowdown in the credit offtake in these segments. This is a typical countercyclical measure that the central bank is imposing on the system to rein in the fairly strong growth in the unsecured segment, and its impact will be felt almost immediately. According to estimates, the banking system will require an additional capital of about ₹85,000 crores, which will mean an immediate increase in rates at which such loans are sold to customers. Also, it is a double whammy for NBFCs for whom the cost of raising funds from banks goes up because risk weightage for exposure to them at banks is up, and their own capital requirement for these segments goes up. Expect a significant deceleration of growth among them and fintechs who used the capital from NBFCs to peddle frictionless unsecured loans on their apps. There are a few interesting macro takeaways that one can read from this action of the central bank. First, it has not sprung this on the sector without reading the tea leaves and then cautioning the players for a period of time. The rate of growth in this segment and the gradual buildup of stress have been on its radar for a while now, and it has privately told a few players to temper their growth. As the growth continued unabated, it followed up with the most potent tool in its hands of raising the risk weights. This might slow economic growth, but the central bank is more concerned about macro-financial stability. To take this call in an election year suggests a fair degree of independence and maturity in doing what’s right rather than falling to the expediency of politics of the moment. To appreciate this, look at the contrasting actions of the central bank in China, which has yo-yo’ed from letting an asset bubble build up in real estate over the years while looking the other way and now taking knee-jerk actions because it favours the political will of the moment. Second, the risk that the central bank sees is an overleveraged borrower with multiple small loans and no collateral who finds it difficult to repay the loans in a rising interest scenario. Some of this scenario is coming to a pass now when one looks at the Transunion CIBIL delinquency table, but this is also a way to derisk more indebtedness among borrowers going forward. This suggests the central bank is keeping its mind open for further rate hikes if the inflation doesn’t come down to 4 per cent. So, it is worried how much the system can sustain more rate hikes and increase in the EMI burden. The best course now is to not add further to this unsecured loan bubble by making it dearer for the banks. This is, therefore, a subtle message that the interest rate hike cycle is only paused for now, and it can’t be said that the direction of the pause has changed towards a lower rate cycle. Lastly, this also supports a point we have made a few times in recent editions. Consumption-driven or total factor productivity-driven GDP growth can only get us so far. Beyond a point, pushing those levers without significant additional cost or risk is difficult. We have had meaningfully slow capital formation for almost a decade now. It must immediately kick off for India to average a 7 per cent or more annual GDP growth rate for the next decade. India Policy Watch #2: Regulating SoHOReflections on current policy issues— Pranay KotasthaneEarlier this week, I came across two disparate news reports on regulations related to the exchange of substances of human origin (SoHO)—a technical term encompassing blood, tissues, cells and organs. Newsflash 1: The European Commission plans to ban financial incentives for donors by limiting compensation to cover the actual costs incurred during the donation process. The proposal wants to make SoHO exchanges voluntary and altruistic. EU wants to do today what India has already done yesterday. Newsflash 2: A study analysing organ donations in India in 2019 showed that 80 per cent of the living organ donors are women, mainly the wife or the mother, while 80 per cent of the recipients are men. All reports on this news item blamed socio-economic pressure without even considering that government policies might have a role to play. So, how should we think about policies restricting SoHO exchanges? When I think about this topic, my mind wanders to the movie Avtaar. Not the science fiction Avatar; I’m talking about the 1980s tear-jerker featuring These concerns about people exchanging SoHO for money made the Supreme Court use its favourite instrument. It banned the exchange of money for blood and shifted to the voluntary and altruistic model in 1996 that the EU wants to adopt now. Similarly, organ donations in India are regulated by the Transplantation of Human Organs Act (1994), which makes organ donation by a non-relative conditional on the permission of an Authorization Committee of the State government set up to prevent ‘comercial dealings in organ transplantation’. Can you anticipate the unintended? Of course, these regulations have led to a shortage of SoHO exchanges in India. Contrary to the portrayal in Avtaar, which makes you believe that a large number of Indians are ready to exchange blood for money, the reality today is that India faces massive blood shortages. This Hindustan Times article tells us that nearly 12000 people in India die every single day due to the unavailability of blood products. Moreover, the well-intentioned ban has predictably not achieved its aim—a well-oiled “professional blood donor” market thrives nationwide. You can search for this term and find seasonal news about such scams. (One particular BBC article from 2015 innocently asks, “Selling blood and paying donors in India is illegal, but across the country, a vast "red market" proliferates.” The writer doesn’t consider that the underground market proliferates precisely because payments are illegal, not despite the ban.) For a country prone to dengue infections which require platelet transfusion, survivors often depend on this illicit market of blood products. Who do we blame then — the tout who saves lives by arranging for blood products illegally or the State that prevents such exchanges because it stops people from monetising SoHO? Going back to the European Commission’s policyWTF, this CEPR article by Axel Ockenfels and Alvin Roth is educative. (Al Roth is a Nobel Prize winner for his work on market design. I like him because of his great blog). They write:

Fascinating. Switching contexts to the second news flash, I found it amusing, though not entirely surprising, that none of the news reports explores if regulations are to be blamed for the skewed sex ratio of organ donors. There’s no doubt that India’s socioeconomic structure contributes to causing more women to donate organs to their male family members. But it’s highly likely that many men are donating organs too, but are doing so in the “underground” market. Since what’s illegal is, by definition, not counted in official statistics, the donors sex ratio appears even more skewed than it might have been. Should India reverse its policy? Perhaps. The crucial point here is that with changing technology and income levels, the concerns that led to the restrictions in the 1990s are far less relevant today. Well-planned payment systems can keep exchanges ethical and ensure enough supply. New medical and tech advances can keep the donation process safe, even if donors get paid. Here again, Ockenfels and Roth have a point:

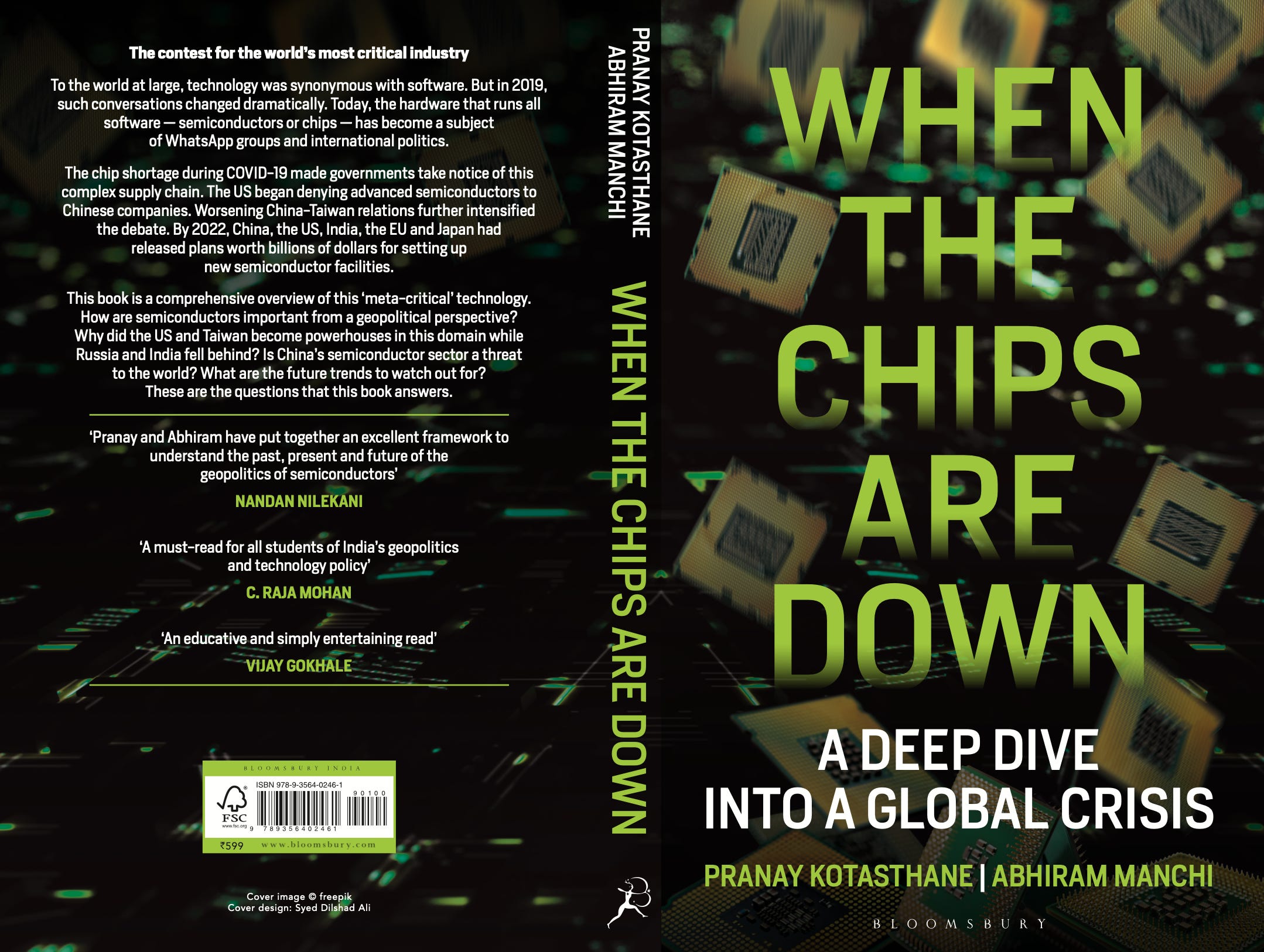

Realistically, we are far away from a policy change on this issue. The Overton Window has shifted far away. But the shocking statistics of deaths due to SoHO shortages in India should probably make us rethink the bans. As for the European Commission, their planned policy move will only increase SoHO imports from outside Europe. As has often happened, the EU will solve problems by externalising the solutions. The New Book Is Out!— Pranay KotasthaneA well-meaning reader pointed out that the newsletter has lately focused too much on semiconductors. That’s partly because my co-author, Abhiram Manchi, and I have been working on a book over the last couple of years. That work has come to fruition now. The book titled When the Chips are Down: A Deep Dive into a Global Crisis is now available in bookstores and on Amazon starting yesterday. So what’s the book about?As two IC design engineers interested in geopolitics, we felt a shortage of Indian perspectives in this domain, even though India is a crucial node of this supply chain. For instance, the otherwise excellent Chip War mentions India just twice, rather offhandedly. I also cringed after attending conferences and discussions where Indians were asking foreigners questions such as “Should India build a chip fab?”. Now, it’s terrific to keep yourself open to ideas from experts regardless of their nationalities. We should learn from the experiences and views of other countries. But surely, the question of whether India should or shouldn’t go down the path of semiconductor manufacturing can and must be answered only by Indians. This book is one such attempt. Here’s the blurb with more details.

Truth be told, I am nervous about how the book will be received. I hope you will enjoy reading it and will recommend it to others. If you like it, consider dropping a review on Amazon. Or send brickbats if you prefer. Regardless, order it now. Global Policy Watch: Beware Of Tech Evangelists Bearing GiftsGlobal policy issues relevant to India— RSJListen, I’m as much a techno-optimist and free marketer as anyone else. But this Techno-Optimist manifesto of Marc Andreesen is a bit much for even me. This is largely self-serving, late-stage ‘capitalism on steroids’ that breeds fevered dreams like finding another planet for humans to colonise and live on rather than making this planet better. Anyway, here’s a sample of the manifesto in case you missed it (you didn’t miss much, really). This is Andreesen identifying the ‘enemies’. Quite illuminating stuff:

Well, empirical evidence suggests elevating anything to a near-mythical god-like status is a bad idea. Further, identifying enemies of that god is worse. But I don’t think Andreesen has too much time to read history. Or, indeed, learn from it. HomeWorkReading and listening recommendations on public policy matters

If you liked this post from Anticipating The Unintended, please spread the word. :) Our top 5 editions thus far: |