| |  | | | | | | | | | | | Hello!

Climate finance is back in the spotlight this week as the World Bank prepares to launch a trust fund to reduce carbon emissions at the COP27 climate change conference in Egypt next month. This comes as U.S. Treasury Secretary Janet Yellen urged the World Bank and other multilateral development banks to dramatically boost lending to address climate change and other pressing global needs. Elsewhere, a new report by the United Nations' Development Programme (UNDP) revealed that the world’s poorest countries needed immediate debt relief to avoid even more extreme poverty and give them a chance of dealing with climate change, whilst a separate report by the European Network on Debt and Development (Eurodad) showed that small developing island states heavily exposed to the effects of climate change spend at least 18 times more on debt servicing than they receive in climate finance.

The World Bank will be launching a trust fund aimed at pooling public funds to provide grants for projects to reduce carbon emissions, including decommissioning coal-fired power plants, its President David Malpass said in a LinkedIn post this week. The Scaling Climate Action by Lowering Emissions (SCALE) fund will provide grants to developing countries as they deliver pre-agreed results in reducing greenhouse gas emissions. SCALE will be the new umbrella trust fund for the bank's results-based climate finance activities. Malpass said the World Bank was in the process of capitalizing the new fund, with the aim of launching it at the COP27 climate change conference in Egypt in November.

Malpass’ announcement came a few days after the U.S. Treasury’s Yellen urged the World Bank Group and other multilateral development banks to harness more private capital and use more concessional loans and grants to fund investments that more broadly benefit the world, such as helping countries transition away from coal power. Yellen also announced a $950 million Treasury loan to the Clean Technology Fund (CTF), a multilateral trust fund that helps developing countries accelerate their transition from coal power to clean energy, the first of its kind from the Treasury.

Meanwhile, a new report by the UNDP estimated that 54 countries, accounting for more than half of the world’s poorest people, now needed immediate debt relief to avoid even more extreme poverty and give them a chance of dealing with climate change. Achim Steiner, UNDP administrator, urged a string of measures, including writing off debt, offering wider relief to greater numbers of countries and even adding special clauses to bond contracts to provide breathing space during crises. It also recommended creditors should have a legal duty to cooperate "in good faith" in Common Framework restructurings and that countries could offer to take eco-friendly measures to encourage creditors to write down their debt.

This comes as a new report by Eurodad found that small island states from Guinea-Bisseau to the Dominican Republic to Samoa received just $1.5 billion in climate finance between them between 2016-2020. Over the same period, 22 of these nations paid more than $26.6 billion to their external creditors, which comprise 50 non-governmental organizations, it said. The group of 37 island states, home to some 65 million people, "urgently need to increase their fiscal space to tackle the multiple challenges and crises facing them," according to Iolanda Fresnillo, one of the authors of the Eurodad report. |  | | | |  |  | | ECB board member Klaas Knot appears at a Dutch parliamentary hearing in The Hague, Netherlands September 23, 2019 REUTERS/Eva Plevier |  | | |  | | • | Companies across Europe are offering one-off bonuses and are under pressure to increase pay to help staff with surging food and energy bills over the winter, while many are bringing forward scheduled wage negotiations. Here are some of the examples by sector. | |  | | |  | | |  | | |  | | | | | Daniele Antonucci, chief economist & macro strategist at Quintet Private Bank | |  | “The latest U.S jobs report will not bring any Federal dovish pivot any closer. We expect the central bank to hike by 75 bps once again in November, a ‘jumbo’ hike that will take the policy rate to 4%.

“That said, we think the Fed’s preferred employment indicator is the ratio of job openings to unemployed right now. While having surged over the last two years, it may now be marking a peak.

“How this ratio evolves until year-end is likely to have a big impact on the Fed’s stance. Let’s not forget, however, that unemployment claims (a more timely measure) remain very low and below the norm.

“Similarly, job creation is still unusually strong for this stage of the business cycle, as today’s data show. And the moderation in wage growth is rather tentative.

“Signs of easing labor market tightness remain very scant. And, while we already saw falling inflation expectations, the recent rise in oil prices may make energy inflation fall less than expected – or even rise.

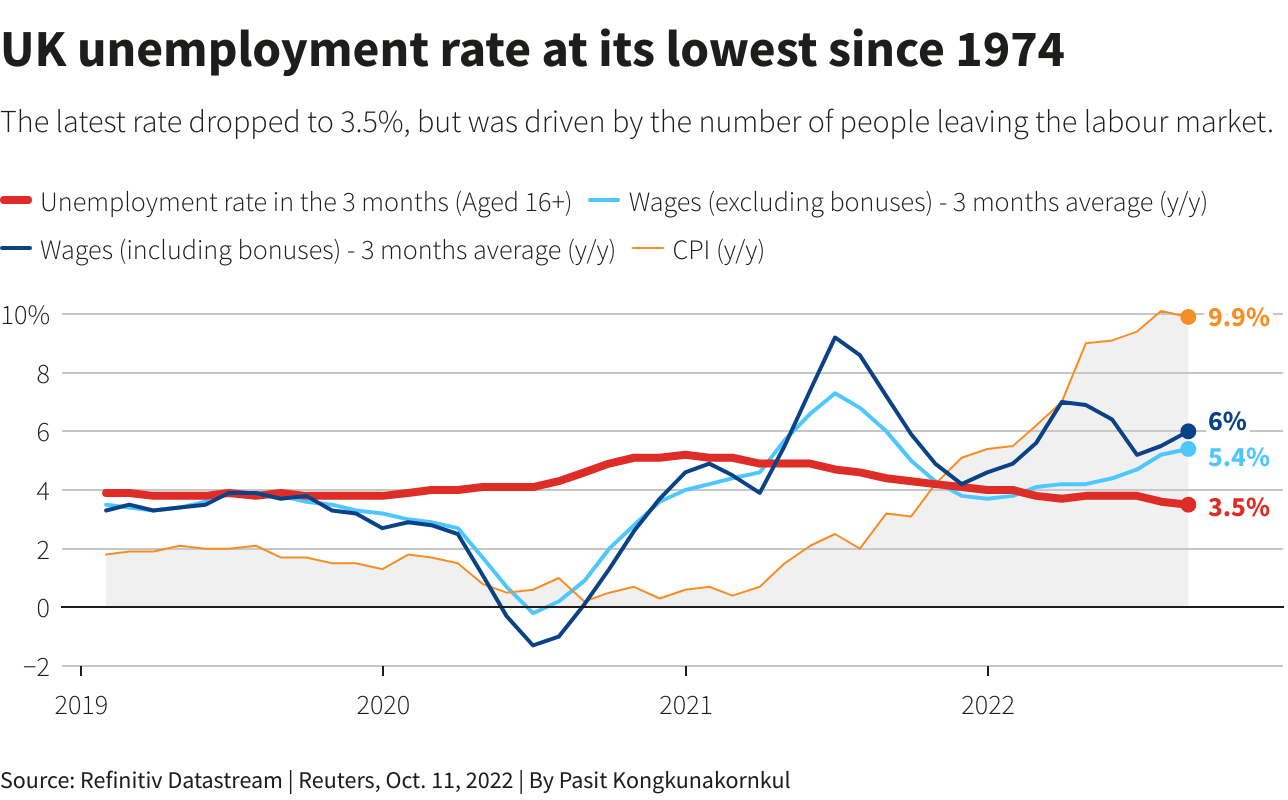

“This is why we still believe that a true dovish pivot (i.e., rate cuts) remains some way off. Of course, a pause in the hiking cycle may be enough to – at least temporarily – provide some relief to risk assets.” | |  | | | | | |  |  | Britain reported a record jump in the number of people leaving the labor market in the three months to August, adding to the Bank of England's inflation headaches. The number of people neither in work nor looking for it rose by 252,000 from the three months to May, the biggest increase since records began in 1971, official data showed.

It is worried that Britain's shrinking labor market will fuel inflation pressures that are also likely to be fanned by Prime Minister Liz Truss's unfunded tax cuts. | |  | | | | Swedish pump manufacturer Concentric has appointed Jennifer Todd-Wilson as vice president human resources & sustainability. Todd-Wilson previously worked as a director of human resources (HR) at American water company Xylem amongst holding other international senior leadership experiences in HR, sustainability and business management in commodities and manufacturing companies.

U.S.-based renewable natural gas company Viridi Energy has hired Dan Crouse as its new chief executive officer. Crouse joins from multinational industrial gas company Air Liquide, where he served as CEO of Air Liquide Advanced Technologies U.S. In that role, he oversaw all the firm's RNG operations in the Americas. Crouse was also CEO at Keystone Renewable Energy, a biogas development business. | |  | International diamond company De Beers has appointed oil and energy industry executive Al Cook as its new chief executive to replace Bruce Cleaver, who leaves the top job after six years at the helm. Cook has 25 years in the energy industry and is currently the vice-president of Norwegian oil major Equinor’s exploration and production business. He will assume De Beers leadership early next year.

BP is hiring an executive to head floating wind energy as it ramps up its presence in the sector. The UK-based energy giant expects to increase its offshore wind staff to around 800 next year from just over 220 now. | |  | | | | | "I've been swimming in the world's oceans for 35 years, and during that time I've seen them change dramatically. The biggest changes I've seen are in the Polar Regions, and in coral reefs. Both are affected by rising temperatures: the poles are melting, and the coral is dying. Ice and coral are the Ground Zeros of the Climate Crisis. These changes are happening before our very eyes.” |  | | UN Patron of the Oceans Lewis Pugh |  | | | | | |  | | • | European Commission president Ursula von der Leyen speaks at the EU Ambassadors Conference 2022 in Brussels on Oct. 12. | |  | | • | Look out on Oct. 12 for our Reuters report on a Jordanian social enterprise that works on collecting plastic bottles and selling them to recycling companies to generate money to support physiotherapy sessions for people with disabilities. | |  | | • | A new brasserie on the first floor of the Eiffel Tower, recently opened by French celebrity chef Thierry Marx, wants to set an example on how to be more environment friendly while saving energy to meet high environment standards, according to a Reuters report due out on Oct. 14. | |  | |  |  | | The Great Reboot |  |  |  | As Japan throws open its doors to visitors this week after more than two years of pandemic isolation, hopes for a tourism boom face tough headwinds amid shuttered shops and a shortage of hospitality workers.

From Tuesday, Japan will reinstate visa-free travel to dozens of countries, ending some of the world's strictest border controls to slow the spread of COVID-19. Prime Minister Fumio Kishida is counting on tourism to help invigorate the economy and reap some benefits from the yen's slide to a 24-year low. |  | |  | |  | We think you may like these: |  |

|  | Reuters Power Up |  | | Find out everything you need to know about the global energy industry and the forces driving the transition to renewable fuels. |  | | Subscribe |  | | Technology Roundup |  | | The latest news and trends in tech sent to your inbox daily. |  | | Subscribe | |  | | | |  | |  | | | |