| The U.S. Drone and Defense Tech Reset Is Underway — And ZenaTech (ZENA) Is Rapidly Positioning Itself to Win!

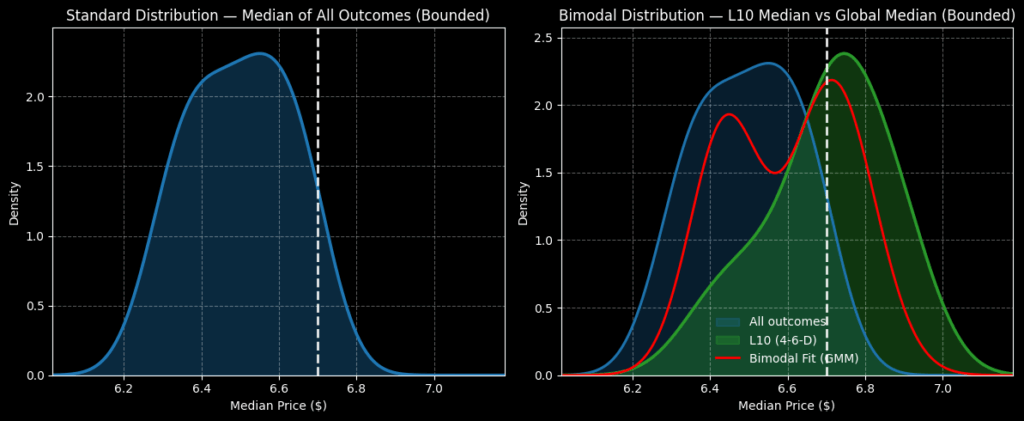

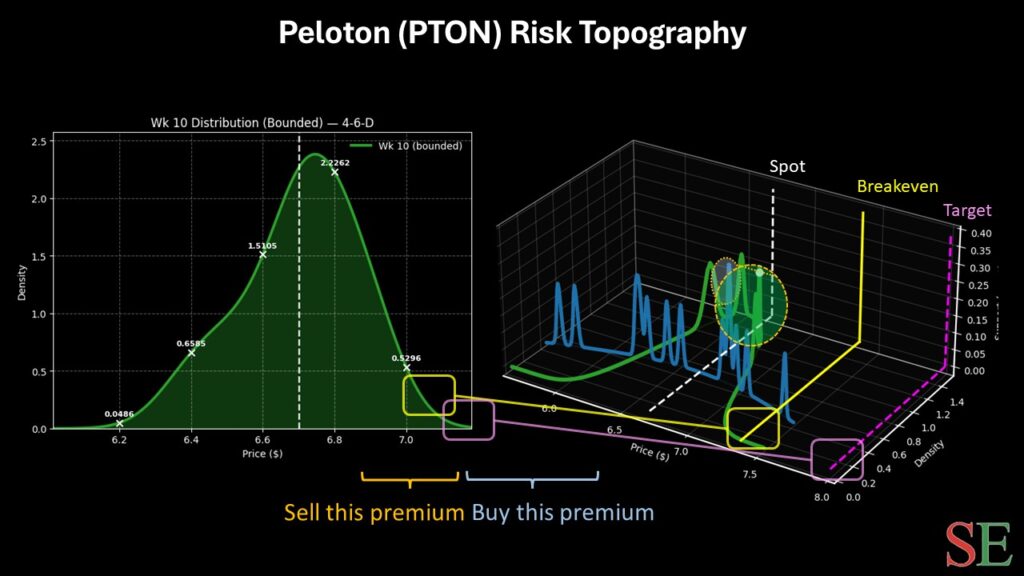

The drone and defense technology sector is undergoing a structural reset as governments move aggressively to secure supply chains, eliminate reliance on foreign-made systems, and deploy AI-enabled autonomy at scale. The global drone market is being forcibly reshaped as the U.S. government cuts off foreign suppliers, tightens national security rules, and accelerates adoption of AI-powered, NDAA-compliant systems for defense, infrastructure, and public safety. This is not a gradual transition — it is a hard pivot driven by executive orders, FCC actions, and defense procurement mandates. The result is a surge in demand for American-built drones that can deliver autonomous intelligence, surveillance, logistics, and inspection capabilities at scale. ZenaTech (NASDAQ: ZENA) stands out as a company already executing inside this transformation. With 1,225% revenue growth in Q3, a rapidly scaling Drone-as-a-Service model, U.S.-based manufacturing, and expanding defense certifications, ZENA is converting policy tailwinds into real revenue. Its integrated ecosystem — spanning AI drones, enterprise SaaS, and advanced R&D in AI and quantum systems — positions the company not just as a drone supplier, but as a next-generation defense and infrastructure technology platform. While competitors are still chasing approvals or burning cash, ZenaTech is scaling revenue, expanding assets, and embedding itself into the next generation of U.S. drone and defense infrastructure. Today's editorial pick for you The Smart Money is Silently Betting on Peloton's (PTON) Earnings TurnaroundPosted On Jan 16, 2026 by Joshua Enomoto Peloton Interactive (NASDAQ: PTON) ranks among the top beneficiaries of the COVID-19 pandemic, which largely explains the current poor performance of PTON stock. During the worldwide crisis, Peloton stock cynically commanded a triple-digit price tag as society was upended. High-contact businesses were seen as liabilities, but people had to get their exercise somehow. Peloton became the readymade answer. Table of ContentsIndeed, the company also benefited from indirect tailwinds from the work-from-home revolution. With companies migrating practically overnight to remote operations, multiple functionalities — particularly the fitness center — suffered a radical paradigm shift. Naturally, the dramatic changes benefited Peloton, with the company's exercise bikes allowing workers to conveniently meet their health and exercise goals. However, as society began normalizing, PTON stock predictably suffered a sharply negative rerating. Combined with rising economic pressures, along with companies either laying off staff or calling them back to the office, home exercise equipment lost much of its charm. This led to PTON stock suffering a trailing-five-year loss of almost 96%. Today, shares can be had for less than seven bucks — but it's also possible that the smart money could be sensing a potential upside opportunity. With its fiscal second-quarter earnings report coming up next month, Peloton just might have a pleasant surprise in store for bullish speculators. Peloton Looks to Shake Off Its CobwebsFor the upcoming print, Wall Street expects Peloton to post a loss per share of 5 cents on revenue of $675.78 million. In fiscal Q2 of last year, the company posted a loss of 24 cents on sales of $673.9 million. Results were mixed, with the red ink on the bottom line coming in worse than the expected 20-cent loss, though top-line growth beat the consensus target of $652.69 million. Overall, the presentation was also mixed. Management showcased significant innovations, particularly with new product releases that integrated artificial intelligence. In addition, the company delivered revenue growth and demonstrated operational discipline. Unfortunately, a large number of product recalls, along with erosion in subscription figures, clouded the narrative. To be fair, PTON stock did pop higher immediately following the results, likely due to the bump up in sales amid a challenging economic backdrop. However, the lift in equity value was short-lived, with PTON falling into a downtrend that has only recently been mitigated. Still, it may be that the security has fallen too far — beyond what the fundamentals reasonably justify. Yes, the product recalls were the most problematic headwind of the most recent earnings disclosure. However, it's an addressable issue. What may be more emblematic of Peloton's future performance is the product innovation and associated revenue growth. If people don't like what a company is selling, that would be the more devastating issue. By contrast, Peloton just proved that the business is very much relevant — and that could be the saving grace for PTON stock. PTON Stock Options Flow May Offer Good TidingsOne of the biggest clues that something special could be brewing for PTON stock comes from the options market, specifically a segment known as options flow. True, derivatives are derivatives, but when Wall Street talks about flow, they're often referring to the context of big block transactions — the kind that generally only institutional investors engage in. Stated differently, while a standard options screener would look at all transactions — which is a real mess — options flow filters for only the biggest trades. By monitoring these high-level transactions across a period of time, retail investors can get a better idea of how the smart money may be positioning itself. As it turns out, on a relative basis, the alpha dogs have been piling into PTON stock. Although there have been many large transactions (again, on a relative basis), the Jan. 13 session stood out the most. On that day, net trade sentiment stood at $812,600 against a total dollar volume of $1.31 million. Moreover, the trade involved the purchase of $10 calls expiring in January 2027, which suggests robust bullishness over the next year. It's also worth pointing out that the delta imbalance on that session stood at roughly $400,000, which suggests an overall positive-leaning bias among market participants. Granted, you don't want to take every detail of the options market as gospel because true intentions can be disguised within complex multi-leg transactions. Nevertheless, I believe it's significant that the smart money has apparently turned optimistic amid a massive five-year implosion of PTON stock. Structure (Usually) Doesn't LieUsing a combination of the Black-Scholes model and implied volatility (IV), various "expected move" calculators project a wide dispersion for PTON stock. For the Feb. 20 expiration date, market makers are anticipating a 14.25% swing in either direction, taking PTON to a possible low of $5.75 to a high of $7.67.  However, the challenge of using Black-Scholes-derived pricing forecasts is that the model represents a first-order analysis. It provides a "clean" framework without the messy and potentially distortive data enhancements of feedback loops, regime shifts and state evolution, among other elements. This blank template allows for quick and scalable reference points for all optionable securities. Unfortunately, by mathematical necessity, it also means that Black-Scholes will never be able to consistently account for the nuances of individual securities. To get a better idea of how PTON stock may respond in context, we need to conduct a second-order analysis, such as one using the Markov property. Essentially, the Markovian framework asserts that what happens tomorrow is largely dependent on what happens today. In the case of Peloton stock, "today" may be defined as the trailing 10-week performance, where PTON printed only four up weeks, leading to an overall downward slope. When this 4-6-D sequence flashes, "tomorrow" — defined as the next 10 weeks — will likely see PTON range between approximately $6 and $8 (assuming a spot price of $6.70). Probability density will likely peak at $6.75, suggesting a slight bullish bias.  Here’s the thing. Under aggregate conditions, PTON stock typically suffers from a decidedly negative bias. Right now, the statistical data suggests that, following an extended downside, the more likely response moving forward is a push higher. Not only that, options flow data supports the notion of bullish speculation. For the risk taker, the 7/8 bull call spread expiring Feb. 20 might not be the worst idea, at least in terms of gambling. For a net debit of only $37, traders will be hoping for PTON stock to rise through the $8 strike price at expiration. If it does, the maximum profit would be $63, a payout of over 170%. This message is a PAID ADVERTISEMENT for ZenaTech, Inc (NASDAQ: ZENA) from Interactive Offers. StockEarnings, Inc. has received a fixed fee of $8000 from Interactive Offers for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between January 20, 2026 and January 26, 2026. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either ZenaTech, Inc (NASDAQ: ZENA) or Interactive Offers. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding ZenaTech, Inc (NASDAQ: ZENA) on EQUISCREEN website for additional information about the relationship between Interactive Offers and ZenaTech, Inc (NASDAQ: ZENA). StockEarnings, Inc |