This isn't just another book about investing in gold.

This is a classified-level survival blueprint from a man who's been trained to stay alive when everything else falls apart.

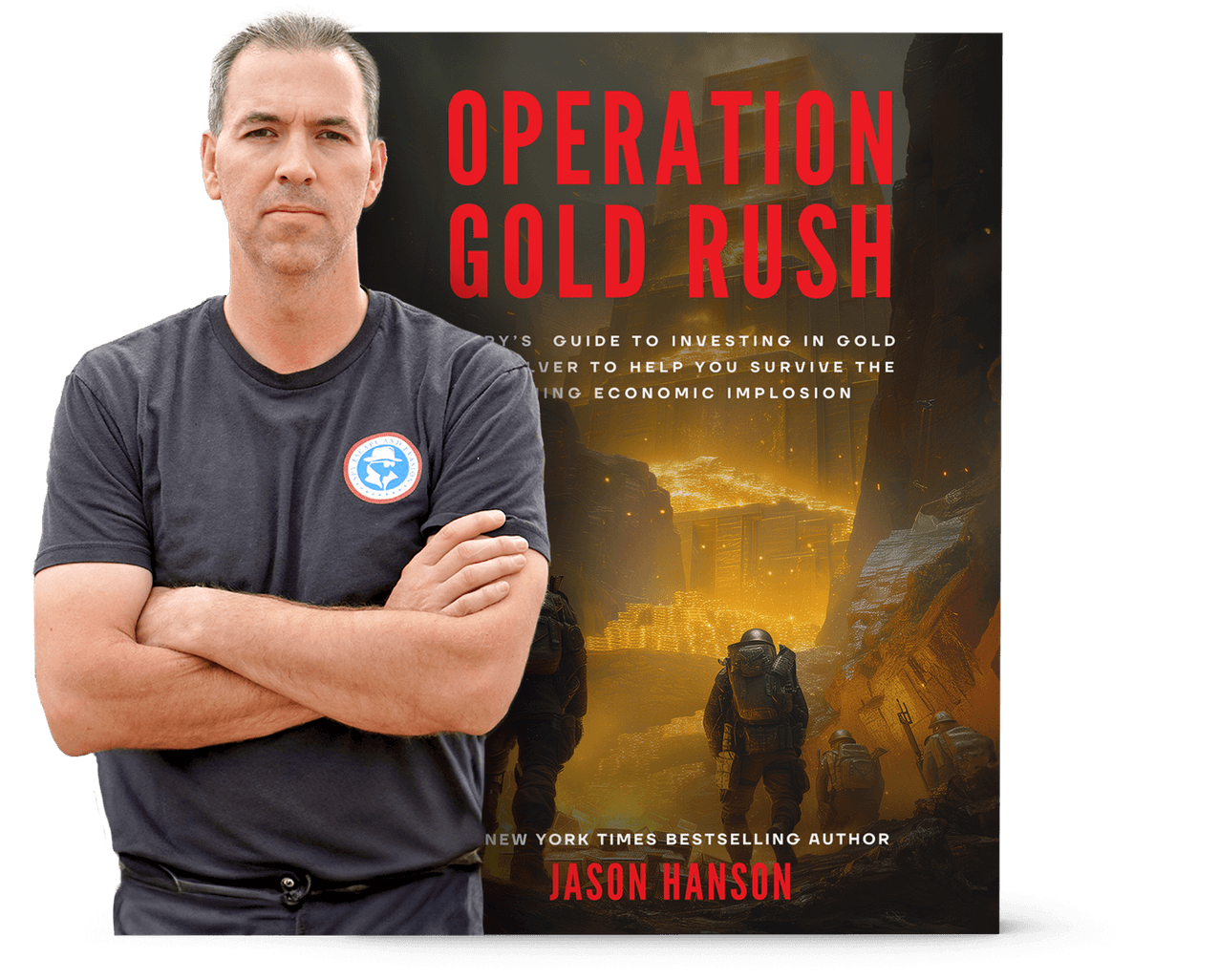

In his new tell-all exposé, Operation Gold Rush, former CIA officer Jason Hanson reveals how gold and silver saved his life—and how they could save yours when America's next crisis hits.

Here's what Jason exposes inside:

- How to hide gold on your person like a covert operative

- Little-known places to stash precious metals where no one will find them

- The 2-tier system Jason uses to protect and multiply his wealth

- How to move your 401(k) or IRA into a Gold IRA—100% tax-free and penalty-free

- What to do when the system fails, the grid goes down, or the markets crash

This is not theory. These are real-world tactics from a man who's been behind enemy lines, seen countries collapse, and helped Americans prepare for the worst.

And now, he's partnered with Advantage Gold—the #1 rated precious metals firm in America—to give away this book for FREE.

Click here to claim your copy before they're gone »

Why now?

Because the next crisis isn't years away. It's unfolding right in front of us:

- Inflation is raging

- Global alliances are collapsing

- Central banks are hoarding gold

- And the U.S. dollar is under attack

If you're relying solely on cash, stocks, or your 401(k)… you're exposed.

Jason knows how fast it can all disappear—he's seen it happen with his own eyes.

This is your warning.

This is your chance to prepare.

Get Operation Gold Rush + up to $10,000 in FREE SILVER now

To your freedom and protection,

Jeremy Blossom

Senior Analyst, Advantage Gold

America's #1 Gold Company – 8 Years in a Row

P.S. This book is too powerful to stay available for long. Once supplies run out or Washington catches wind of what Jason's revealing—it's over.

Get your free copy + qualify for up to $10,000 in free silver now »

Battle of the Black Friday Stocks: Amazon vs. Walmart vs. Target

Written by Nathan Reiff. Published 11/17/2025.

Key Points

- U.S. consumers are projected to spend more than $1 trillion on holiday shopping for the first time ever.

- Major retailers like Amazon, Walmart, and Target are poised to benefit from this trend.

- Walmart's omnichannel approach may give it an advantage on Black Friday, but Amazon's unparalleled logistics network and competitive pricing make it an overall holiday retail winner.

As Black Friday's reach now extends to Small Business Saturday, Cyber Monday and, in some cases, the entire month of November, retail sales have expanded accordingly.

The National Retail Federation estimates that the 2025 winter holidays (November through December) will generate more than $1 trillion in U.S. retail sales for the first time, an increase of roughly 3.7%–4.2% over 2024. Despite headwinds from cooling consumer confidence and inflation, Black Friday remains a key driver of early holiday-season spending.

Buy This Gold Stock Before Wall Street's AI Wakes Up (Ad)

AI-driven trading now dominates the gold sector, instantly buying up producers the moment earnings hit EDGAR or SEDAR. But these systems have one major blind spot: they can't identify pre-production miners. Until a company reports its first revenue, it's invisible to every AI model on Wall Street — which is why early-stage gold stocks often see their biggest move right before earnings go public.

Garrett Goggin says one small miner is only weeks from first production and positioned to show its first earnings in early 2026 — the moment AI systems will finally recognize it. He recently sat down with the company's leadership and released a full briefing on the project, the timeline, and how early investors can position before the algos catch on.

Three core retailers positioned to benefit from post-Thanksgiving spending are Amazon.com Inc. (NASDAQ: AMZN), Walmart Inc. (NYSE: WMT), and Target Corp. (NYSE: TGT). How might these retail giants perform in 2025, and which is likely to come out on top?

Amazon: The Online Juggernaut

In the United States, Amazon remains the undisputed leader in online retail.

Although the e-commerce giant has expanded into cloud, advertising and other services, its retail business is still substantial. The company's Black Friday deals run for nearly two weeks, from November 20 to December 1, and cover sales across all categories; electronics, toys and beauty are traditionally among the top sellers during this period.

In 2024, the company hosted its most successful Black Friday event to date. It also consistently posts the lowest online prices of any major U.S. retailer—a trend it has maintained for nearly a decade. Amazon's vast assortment and ability to undercut competitors on price are enabled by its logistics advantages.

The firm is even preparing to use its distribution network to disrupt the grocery space, one of the few areas where brick-and-mortar stores have retained an edge.

Walmart: The Omnichannel King

Although it started as a traditional retailer, Walmart has successfully pivoted to an omnichannel strategy that blends in-store experiences with online retail.

This approach has served the company well in the U.S. and abroad, helping to drive some of its best earnings in recent quarters.

Walmart has also lured some third-party sellers away from Amazon, making its e-commerce marketplace an important engine of growth.

Moreover, Walmart's extensive fulfillment network allows it to price competitively and manage inventory for both in-store and online demand. The company also benefits from one of the most loyal customer bases among leading retailers.

Target: The Challenger

Though a household name, Target's smaller scale relative to Amazon and Walmart has required it to carve out a niche for Black Friday success.

The company emphasizes curation—maintaining a narrower third-party marketplace and a more selective assortment of brands than some competitors.

That focus has helped Target build a reputation for delivering good value on quality items across multiple categories. Its store pickup program, where customers order online and collect items in person, became popular during the COVID-19 pandemic and remains widely used.

Target has faced challenges in recent quarters, including a consumer boycott after it rolled back parts of its DEI program. The Black Friday period could be an opportunity for the company to regain momentum or to fall further behind.

Key Metrics Comparison

On a year-to-date (YTD) basis, Walmart has the most momentum heading into Black Friday. WMT shares are up about 14% this year, compared with gains of roughly 8% for AMZN and a decline of about 34% for TGT.

Looking at holiday revenue estimates, Amazon forecasts fourth-quarter revenues between $206 billion and $213 billion; neither Walmart nor Target has provided public holiday revenue forecasts as of this writing. Amazon's online store sales for the latest quarter reached $67.4 billion, a 10% year-over-year increase, representing roughly 63% of total sales for the period.

Walmart's latest annual report shows $121 billion in online sales, accounting for just under 18% of total revenue during the period.

Target doesn't provide a similar online-sales breakdown, but digital comparable sales growth has recently outpaced overall sales growth.

So, Who Wins Black Friday 2025?

Given its broad omnichannel strategy, large and loyal customer base, and competitive pricing, Walmart looks well positioned to lead the Black Friday retail race this year.

Investors hoping to capitalize on that performance might consider buying shares in the run-up to its earnings release, expected on November 20, which will include commentary on the Black Friday period.

That said, looking at the broader retail landscape, Amazon could still emerge as the overall winner. It is uniquely positioned to dominate across a wider range of products at lower prices and benefits from the additional tailwinds of AWS and its advertising business.

Finally, while Black Friday is primarily a U.S.-centered event, the broader holiday season matters globally, and Amazon's international reach gives it an extra advantage.

This email content is a sponsored message sent on behalf of Advantage Gold, a third-party advertiser of The Early Bird and MarketBeat.

If you have questions about your subscription, don't hesitate to contact MarketBeat's South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from The Early Bird, you can unsubscribe.

© 2006-2025 MarketBeat Media, LLC.

345 North Reid Place, Sixth Floor, Sioux Falls, SD 57103-7078. United States..