*Sponsored

Krypton Street Announces Coverage On Palisade Bio, Inc. (Nasdaq: PALI) Starting This Morning—Friday, September 5, 2025.

(PALI) Comes Backed By Several Potential Catalysts—But Here's What

We Can Tell You Right Now…

Small Float: (PALI) Has Fewer Than 10M Shares In Its Float, Which Could Lead To The Potential For Big Moves If Demand Starts To Shift.

Analyst Targets: Coverage On (PALI) Spans Up To $16, Which Suggests Over 2,400% Upside Potential From Recent Levels.

Under The Radar: (PALI) Is Trending Under $1 And Could Land On More Screens If Fresh Attention Builds.

Recent Momentum: (PALI) Made An Approximate 216% Move In Under Five Months, Including An Approx. 61% Recent Pop In Under 24 Hours.

First-In-Class Potential: (PALI) Is Developing PALI-2108, Targeting FSCD

— A Market Estimated At $14.5B To Over $40B.

Pull Up (PALI) This Morning Before The Bell Rings…

September 5, 2025

Early Eyes | See Why (Nasdaq: PALI) Just Hit Our Radar This Morning—Look Now Dear Reader, It's rare to find a sub-dollar profile with both a small float and active analyst coverage. But when you do, history shows those names don't stay quiet for long. The potential for big moves, if demand begins to shift, could already be in place. Which is why Palisade Bio, Inc. (Nasdaq: PALI) just hit our watchlist this morning—Friday, September 5, 2025. Palisade Bio, Inc. (Nasdaq: PALI) has recently started drawing fresh attention. The company's shares are currently trending below $1, yet the float sits at fewer than 10M shares. That combination alone could amplify the potential for momentum of interest changes. In fact, (PALI) made an approximate 216% move in under 5 months from around $.60 on April 4 to $1.90 on August 7. With multiple double-digit moves from one session to the next including an approximate 61% move between July 22-23. Add in multiple analyst targets — some projecting as high as 2,400% upside potential — and you begin to see why this profile is starting to land on watchlists. Analyst Coverage That You Can't Ignore

Three firms have recently placed coverage on (PALI): - Ladenburg Thalman & Co. Inc. (Aydin Huseynov) set a $14 target just yesterday, September 4, 2025 — suggesting roughly 2,000% upside potential.

- Maxim Group (Naz Rahman) issued a $2 target last week, August 29, 2025 — which suggests around 200% potential upside.

- Brookline Capital Markets (Kumaraguru Raja, PhD) set a $16 target earlier this year— which suggests approximately 2,400% upside potential from recent levels.

These aren't just arbitrary numbers. They reflect the scale of the company's pipeline, clinical positioning, and its differentiation within one of the largest therapeutic markets in the world: inflammatory bowel disease (IBD). The PALI-2108 Program

At the core of Palisade Bio's story is PALI-2108, a first-of-its-kind oral prodr-ug aimed at treating both fibrostenotic Crohn's disease (FSCD) and ulcerative colitis (UC). Why This Matters

FSCD currently has no approved therapies. Patients are often left cycling through corticosteroids, surgeries, or endoscopic procedures — none of which fully address the fibrotic pathways driving the condition. For UC, while treatment options exist, remission rates remain modest. Biologics, JAK inhibitors, and other advanced therapies carry meaningful safety considerations, leaving a clear need for alternatives. PALI-2108 takes a differentiated approach. By targeting PDE4 B/D enzymes locally in the gut, it is designed to deliver dual-action benefits — anti-inflammatory and anti-fibrotic — while avoiding the systemic side effects that have hampered other PDE4 inhibitors. Phase 1 Data: Safety and Precision

In its Phase 1a/b program, PALI-2108 demonstrated: - Strong safety and tolerability, even at higher repeat doses.

- Local bioactivation in the ileum and colon, confirming the prodr-ug worked as designed.

- Improved pharmacokinetics, with an extended half-life that supports more convenient dosing.

What stands out is that across 89 patients treated, no severe adverse events were reported.

For a therapy with first-in-class potential, this safety profile builds confidence heading into larger trials. Why FSCD Could Be Transformational

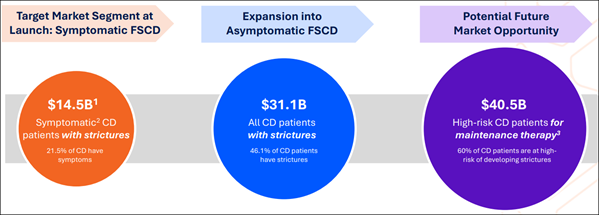

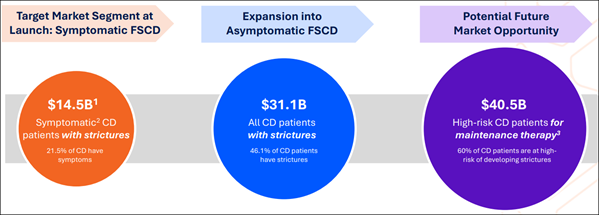

Fibrostenotic Crohn's disease affects nearly half of Crohn's patients, yet no approved therapy exists that directly targets fibrosis. Palisade Bio estimates this segment alone could represent a market worth about $14.5B, expanding to over $31B when all Crohn's patients with strictures are considered, and potentially more than $40B when high-risk populations are factored in. That positioning — first-in-class and best-in-class potential in a condition with no current solutions — is one reason analysts have issued such bold targets on PALI. Ulcerative Colitis: Precision Medicine Advantage

Beyond FSCD, PALI-2108 is advancing in UC with a companion diagnostic (CDx) under development. This tool uses machine learning to identify patients most likely to respond, mirroring how HER2 testing transformed breast cancer care. If successful, it could significantly improve remission rates by ensuring therapy is directed to the right population. Market Backdrop

The IBD market across Crohn's and UC therapies is already valued at more than $50B. Advanced treatments like biologics, JAK inhibitors, and S1P modulators generate over $10B annually — yet penetration remains relatively low, often ranging between just 1% and 28% of eligible patients depending on the dr-ug class. That leaves a broad pool of patients still searching for more effective and tolerable options. An oral therapy that combines safety, efficacy, and precision could capture meaningful attention in this landscape. Near-Term Milestones

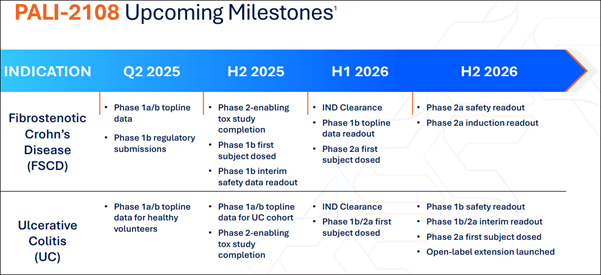

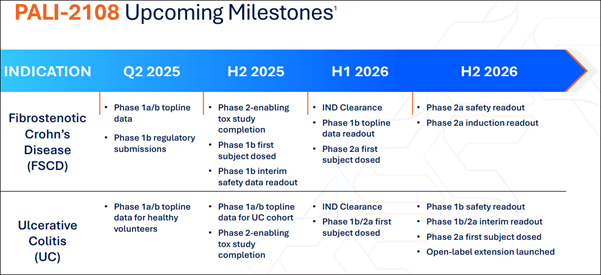

Over the next 12–18 months, Palisade Bio anticipates several important readouts: - Phase 1b initiation in FSCD with interim safety data.

- Phase 1b/2a in UC, including CDx-selected responder analysis.

- Advancement into Phase 2 studies, potentially setting the stage for pivotal programs.

With the market wide open and potential catalysts on the near horizon, this setup is too sharp to ignore. Here's why (PALI) just landed on our radar this morning. 7 Reasons Why (PALI) Just Hit Our Watchlist This Morning

—Friday, September 5, 2025

1. Small Float: With fewer than 10M shares listed as available in the public float, (PALI) could have the potential for big moves if demand begins to shift. 2. Analyst Targets: Coverage on (PALI) ranges from $2 to $16, with projections that stretch as high as 2,400% upside potential. 3. Under The Radar: Shares of (PALI) are currently trending under $1, a level that could start flashing on more screens fast if fresh attention begins to build. 4. Recent Momentum: In under five months, (PALI) moved approximately 216% from $0.60 to $1.90, including an approx. 61% pop between July 22–23. 5. First-in-Class Potential: (PALI) is developing PALI-2108, a candidate that could become the first approved therapy for fibrostenotic Crohn's disease — a segment the company estimates at $14.5B, expanding to over $31B with strictures included, and potentially more than $40B in high-risk populations. 6. Precision Strategy: For ulcerative colitis, (PALI) is advancing a companion diagnostic designed to match patients more accurately to treatment. 7. Upcoming Milestones: Over the next 12–18 months, (PALI) expects multiple Phase 1b and Phase 2 readouts that could drive fresh visibility. Pull Up (PALI) This Morning Before The Bell Rings…

When you line up all the factors — a float under 10M shares, analyst targets ranging up to 2,400% upside potential, trending below $1, recent triple-digit moves, and a first-in-class program with market potential from $14.5B to over $40B — it's clear why Palisade Bio, Inc. (Nasdaq: PALI) just landed on our radar. Add in the precision approach to UC and multiple near-term milestones, and the setup is hard to ignore. We have all eyes on (PALI) this morning. Take a look at this while it's still early. Keep an eye out for my next update, it could be here within the next 20–30 minutes. Sincerely,

Alex Ramsay

Co-Founder / Managing Editor

Krypton Street Newsletter |