| Smart analysis. Better decisions. | | | | | Hello Readers,

Purses in the private-equity world are tightening. Investments in startups by venture-capital funds halved to $1.6 billion across 82 deals in April. And funds are stocking up on dry powder for deserving business models in their portfolios.

Startups across sectors are revising growth plans amid various challenges, which we have covered in detail.

Here are our exclusive stories of the week.

[Fintech] RBI turned down Navi’s request for a banking licence, dealing a blow to Sachin Bansal’s ambitions to build a $100-billion company. What worked against Navi, which can now reapply only after three years. More importantly, what can Bansal, who co-founded Flipkart, do in this period to boost Navi’s chances? Pratik has the inside story. A must read.

[Ecommerce] In five years, social, video and reseller commerce startups have seen their peak and bottom. In 2015, founders bet that the next billion new-to-internet users will get accustomed to social buying. Subsequently, Bulbul, Simsim, Glowroad and Meesho thrived. But in the last 18 months, these startups have moved towards consolidation or pivoted. Was the hypothesis of a standalone billion-dollar outcome far-fetched? Aditi finds out.

[Fintech] Digital lenders have had a very difficult time, grappling with Covid-19 and a bad asset pile-up. Their best bet for a turnaround is co-lending partnerships with banks, the organisations they were meant to challenge. But are banks as excited about such arrangements and what are the challenges? Pratik has the answers .

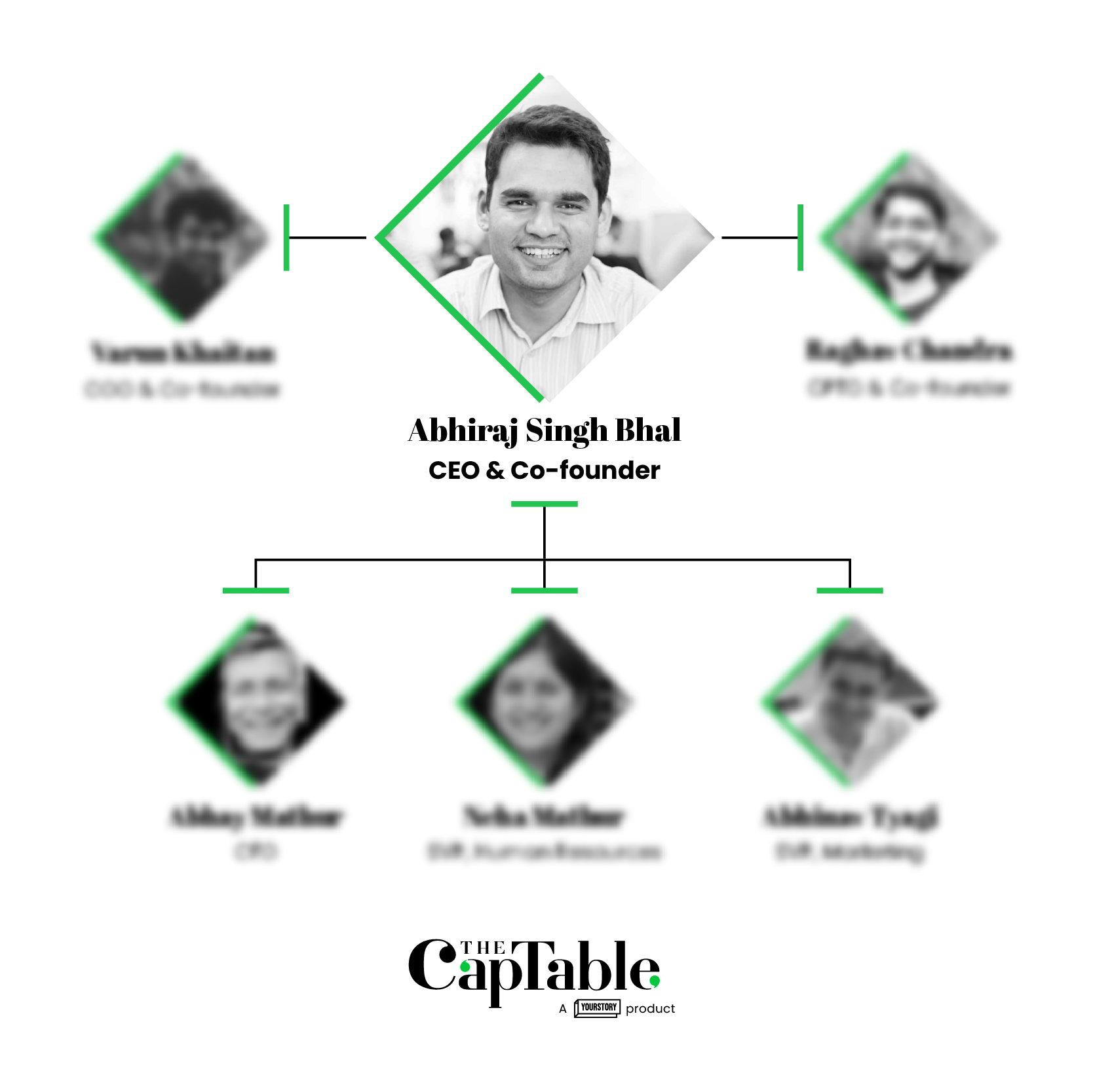

[Org Chart] Urban Company is among the few startups that have cracked the challenging market of home services. Its ability to undertake structural rejigs periodically, based on how the business is evolving, and promote talent to key roles has played an important role in its success. Supriya has mapped its org chart and leadership style. |  | | [The Crux | Free Read] In the latest edition of The Crux, delivered straight to your inbox, Aditi has a scoop on Ola. The ride-hailing company has told investors that its IPO timeline has been pushed back by two years to November 2024. Pratik unpacks PhonePe’s acquisition of WealthDesk , which has deep business integration with Paytm Money.

That is all from us this week!

To access our Premium Reads and Org Charts of companies such as Flipkart, Razorpay and Unacademy, subscribe here .

Cheers,

Team CapTable | | | | | | | Follow us on social media

| | | | | | |