Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

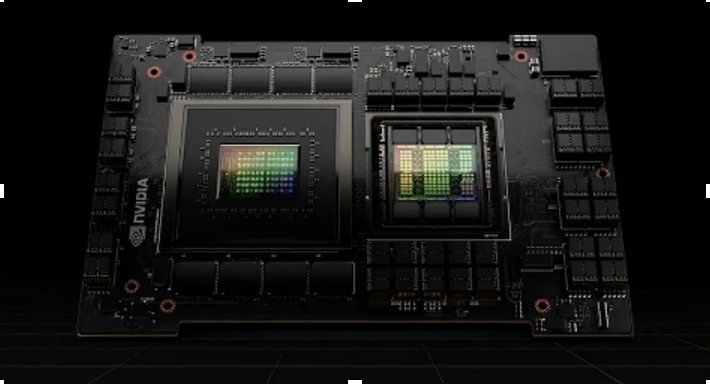

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

This Month's Exclusive Story Berkshire Bought the Dip—Now Constellation Brands Is ReboundingSubmitted by Leo Miller. Published: 1/9/2026.

Key Takeaways- Constellation Brands is rebounding sharply in early 2026 after a 36% loss last year, with its Q3 earnings beating expectations.

- Berkshire Hathaway increased its stake in STZ despite the stock’s downturn, signaling long-term confidence in its recovery potential.

- Strong beer segment performance, improving margins, and analyst price targets point to upside, even as broader alcohol demand remains uncertain.

After a difficult 2025, shares of beer giant Constellation Brands (NYSE: STZ) are starting 2026 on a brighter note. Constellation delivered a total return of -36% last year, a decline that significantly affected Berkshire Hathaway (NYSE: BRK.B), which initiated a position in Constellation in Q4 2024. As of September 2025, Berkshire held 13.4 million Constellation shares, valued at about $1.8 billion at the time. General weakness in the beer market and among Constellation's customers contributed to the stock's decline. The company lowered its full-year fiscal 2026 (FY2026) guidance in September 2025 to reflect the challenging backdrop. Note that Constellation's fiscal year runs several quarters ahead of the calendar year. Just like Microsoft and Adobe rode the software wave in Web 1.0, RAD Intel is riding the AI software wave in 2025. Their product helps brands instantly find the right audience and message using AI – solving the #1 waste in marketing: misfired ad spend.

Already trusted by a who's-who of Fortune 1000 brands and leading global agencies – with recurring seven-figure partnerships in place. With a Nasdaq ticker reserved, $RADI, it's early – but very real. $0.85 Won't Last – Secure Your Shares Now. As of the Jan. 8 close, Constellation shares were up more than 7% in 2026 and have rallied roughly 16% since hitting a 2025 low near $128 in November. The stock jumped about 5.3% after the company's latest earnings release. Below is a look at those results and what they mean for the stock. Constellation Delivers Impressive Bottom-Line BeatIn Q3 FY2026, Constellation reported net revenue of $2.22 billion — down 10% year-over-year but about $52 million above analysts' estimates. Comparable earnings per share were $3.06, roughly a 6% decline from a year earlier but well ahead of the consensus $2.63 (which implied a 19% drop). The company's beer segment, which accounted for roughly 90% of revenue, saw sales decline 1%. That performance nonetheless outpaced the broader beer industry and allowed Constellation to gain market share. In Q1 and Q2 FY2026, Constellation led the beer category in dollar share gains, a trend that also held in FY2025. Despite the sales decline, the beer segment's operating margin rose 10 basis points, reflecting effective cost management. Weaker results in the Wine & Spirits segment weighed on the company's overall growth. Wine & Spirits sales fell 51%, largely because Constellation divested SVEDKA vodka and parts of its wine portfolio. Excluding those divestitures, Wine & Spirits revenue fell about 7%. On a pro forma basis that adjusts for those portfolio changes, companywide sales declined roughly 2% versus the reported 10% drop. Viewed this way, Constellation's quarter was stronger than the headline figures suggested. Coming Off Multi-Year Lows, STZ Could Have Significant Room to RunTrading around $148, Constellation has only partially recovered from its 2025 low near $128. That low was not only the stock's weakest level last year but also its lowest since April 2020, shortly after the COVID-19 market crash. Put differently, Constellation is not merely rebounding from a short-term trough — it's recovering from a multi-year drawdown, which leaves meaningful upside potential if the recovery continues. Berkshire Buys and Price Targets Support Constellation's PotentialBerkshire bought over 6 million Constellation shares in Q1 2025, a quarter in which the stock's lowest closing price was $158. That price is roughly 7% above Constellation's current trading level, suggesting Berkshire's purchases were at higher levels than today's market price. Since its initial stake, Berkshire increased its Constellation holdings, signaling continued conviction even as the stock fell. That activity implies Berkshire may still see substantial appreciation potential for the company. Wall Street analysts also see upside. The MarketBeat consensus price target of about $182 implies roughly 23% upside from current levels. There are headwinds: a recent Gallup survey found that only 54% of Americans reported drinking alcohol — the lowest reading on record. That said, similar declines have occurred in the past and were followed by recoveries, suggesting the trend may be cyclical rather than structural. A rebound in drinking rates would be a meaningful tailwind for Constellation. Given the company's consistent beer-segment share gains, recent margin resilience and a valuation that points to upside, Constellation's outlook currently skews positive.

|