Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

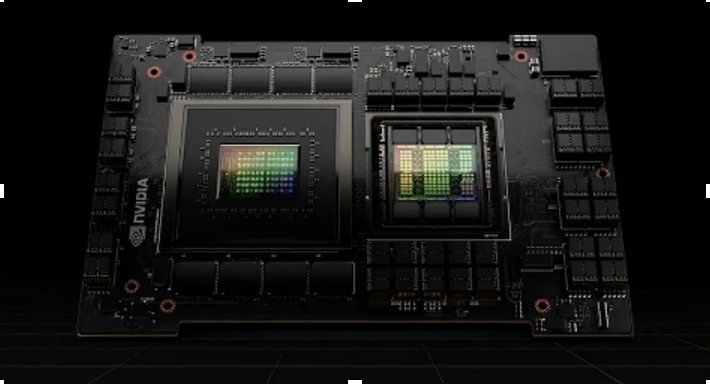

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

Small-Cap Standouts: These 3 Stocks Rose Over 300% in 2025

Written by Leo Miller. Published: 1/3/2026.

Article Highlights

- While small caps as a whole generated lower returns than large caps in 2025, three interesting names bucked this narrative.

- A cancer screening company and two satellite operators saw their shares rise 300% or more.

- See where analysts are forecasting upside and understand vital considerations pertaining to smaller stocks.

In 2025, small-cap stocks generally underperformed. The Russell 2000 Index, which tracks 2,000 U.S. small-cap stocks, returned about 13% that year. That was notably below the S&P 500 Index's roughly 18% total return, which tracks U.S. large-cap stocks.

Despite the broader lag, three names stood out for exceptional performance in 2025. Below, we detail three stocks that posted gains of 300% or more. Each began 2025 in small-cap territory but, after their rallies, has moved into mid-cap status.

GRAL Catapults on Early Cancer Detection Enthusiasm

Trade this between 9:30 and 10:45 am EST (Ad)

If you want a way to generate consistent market income without chasing volatile AI stocks or complex crypto trades, you'll want to see my new e-book, How To Master The Retirement Trade. It reveals a simple, time-based strategy that targets trades designed to play out in as little as 11 hours — no guesswork, no hype.

Claim your free copy of How To Master The Retirement Trade nowHealthcare stock GRAIL (NASDAQ: GRAL) jumped roughly 380% in 2025, driving its market capitalization from under $1 billion to about $3.3 billion. The company's primary offering is the Galleri multi-cancer early detection test.

Early detection greatly improves cancer survival odds, which has driven substantial interest in Galleri. Only about five cancer types have standardized screening methods, yet roughly 70% of cancer deaths arise from cancers outside those five — so GRAIL designed Galleri to detect more than 50 cancer types. In a recent study, GRAIL reported that adding Galleri to traditional screening increased early cancer detection by more than sevenfold.

Currently, most Galleri revenue comes from out-of-pocket payments. GRAIL expects to apply for Premarket Approval (PMA) from the U.S. Food and Drug Administration in the first quarter of 2026; if approved, commercial insurance coverage would become much more likely and could open a significant new sales channel. That potential approval is a key driver of investor enthusiasm.

The MarketBeat consensus price target of $97.50 reflects analysts' optimism and implies roughly 14% upside from current levels.

PL Blasts Off, Combining AI with Geospatial Imagery

Planet Labs PBC (NYSE: PL) enjoyed a blockbuster 2025, with shares rising just under 390%. Planet operates a large fleet of satellites that collect medium- to high-resolution images of Earth and pairs that imagery with artificial intelligence to help customers make decisions. The company sells subscriptions to its cloud-based software platform and satellite services.

Demand has been especially strong among government customers. Its Dec. 10 earnings report sent shares up about 35% in a day, driven by defense and intelligence revenue rising more than 70%. The firm reported a backlog of roughly $735 million — about 2.6 times its trailing 12-month revenue of $282 million — which supports potential for significant growth. Planet Labs also recorded positive free cash flow for the second consecutive quarter.

The MarketBeat consensus price target of $14.74 implies roughly 25% downside. However, analyst targets updated after the company's latest earnings average $18.19, which implies about 7.7% downside. Planet Labs remains worth watching; a meaningful pullback could present a more attractive entry point.

Updated Targets Eye Strong Upside in VSAT After Huge 2025 Run

Finally, Viasat (NASDAQ: VSAT) gained about 305% in 2025, lifting its market cap to roughly $4.7 billion. Viasat is another satellite company but focuses on internet and data connectivity rather than consumer-facing telecom services. Its customer base includes aviation, maritime, and government clients, somewhat differing from peers like AST SpaceMobile (NASDAQ: ASTS).

For example, Viasat provides in-flight wireless connectivity to thousands of commercial and business aircraft. The U.S. government was Viasat's largest customer in fiscal 2025, accounting for 18% of revenue. (Viasat is currently in fiscal 2026.) Revenues grew by just 2% last quarter, but contract awards rose 17% to nearly $1.5 billion and the backlog increased to almost $3.9 billion.

The MarketBeat consensus price target of $32.75 implies about 5% downside. However, analyst targets revised after the Nov. 7 earnings report average $49, suggesting roughly 37% upside potential.

GRAL, PL, VSAT: Deep Research Is Paramount

Overall, GRAL, PL, and VSAT delivered remarkable returns in 2025. While these stocks are exciting, investors should remember that smaller-cap names — especially those that have run up sharply — can be highly volatile. Confidence in a stock's long-term outlook and thorough due diligence are essential before making investment decisions.

This email content is a sponsored message for Paradigm Press, a third-party advertiser of DividendStocks.com and MarketBeat.

If you need help with your account, please feel free to contact our South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from DividendStocks.com, you can unsubscribe.

Copyright 2006-2026 MarketBeat Media, LLC. All rights protected.

345 N Reid Pl., Sixth Floor, Sioux Falls, S.D. 57103-7078. U.S.A..