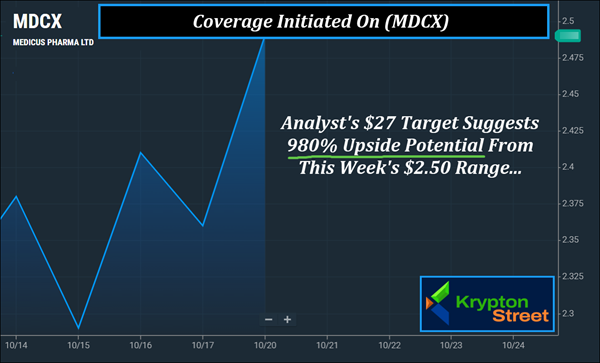

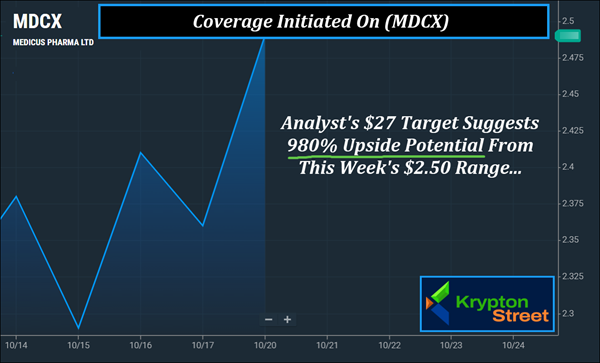

*Disseminated on Behalf of Medicus Pharma Ltd.

Krypton Street Announces Coverage On (NASDAQ: MDCX) Starting

This Morning—Tuesday, October 21, 2025

Here's Why….

An Analyst Target As High As $27 For (MDCX), Suggest 980%

Upside Potential From This Week's Range.

(MDCX) Has Moved Approximately 70% In Three Weeks And It's Now

Trending Above Its 5, 20, And 50-Day Moving Averages. With A Tiny Float Of Less Than 5M Shares, (MDCX) Could Have The

Potential For Big Moves If Demand Starts To Shift. Take A Look At (MDCX) Before The Bell Rings…

October 21, 2025

Final Check | (MDCX) Just Hit The Top Of Our Watchlist Ahead Of The Bell Dear Reader, There's less than 10 minutes to go before the bell rings. Have you pulled up (MDCX) yet? In this game, timing matters. Not the news cycle. Not the noise. Timing. Right now, Medicus Pharma Ltd. (NASDAQ: MDCX) is stepping into a moment that could define its potential path—and this morning, October 21, 2025, could be part of that timing. Over the past several weeks, (MDCX) has gone from $1.79 on September 4 to $3.05 by September 23, marking an approximate 70% move in under a month. More recently, (MDCX) made another 24% move (approx.) in less than 10 sessions, from $2.18 on October 1 to $2.71 on October 20. The chart now shows (MDCX) trending near or above its 5-, 20-, and 50-day moving averages, showcasing its potential for technical strength. Adding to that momentum, D. Boral Capital analyst Jason Kolbert recently set a $27 target on (MDCX) — suggesting 980% upside potential from recent levels — while Maxim Group's Jason McCarthy reiterated a $20 target, reflecting continued confidence in the company's outlook. Analyst $27 Target Suggests 980% Upside Potential

Following its recent acquisition of Antev Limited, (MDCX) has expanded into two late-stage therapeutic programs addressing major clinical needs. But keep in mind, (MDCX) has an ultra-small float, with fewer than 5 Mln shares listed as available to the public according to MarketWatch. Insider ownership is also reported at over 50%, a level that could reflect a management team's confidence in the company's direction. With analyst coverage, regulatory progress, and technical momentum all converging, (MDCX) stands out as one of the biotech names to watch heading into this morning's session. FDA Input Positions SkinJect for Advancing International Phase 2 Work

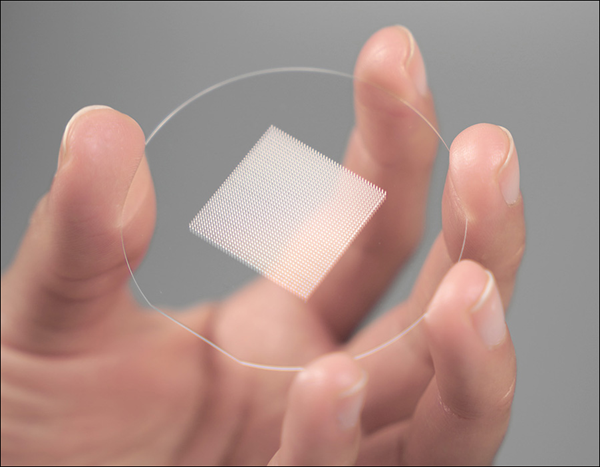

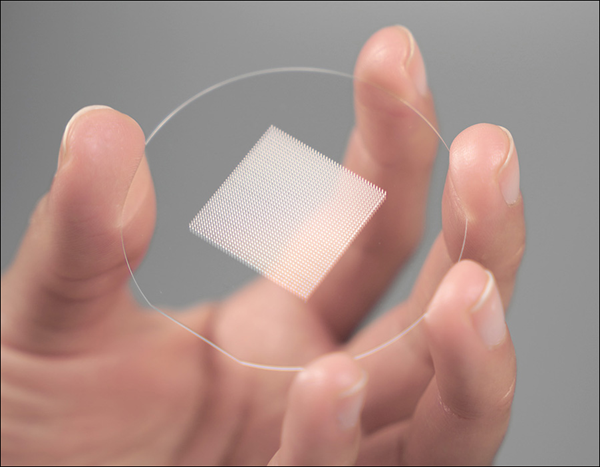

Medicus Pharma Ltd. (NASDAQ: MDCX) has announced positive feedback from a Type C meeting with the U.S. FDA regarding its SkinJect program — a dissolvable microneedle patch designed to non-invasively treat basal cell carcinoma (BCC). The FDA agreed that the company may pursue the 505(b)(2) regulatory pathway, a streamlined route that could reduce both cost and development time by leveraging existing doxorubicin safety data.

The agency also provided constructive guidance on study design, endpoints, and formulation refinements, including recommendations for an adhesive layer and applicator system to improve precision and consistency. (MDCX) is currently advancing two Phase 2 studies for its SkinJect program. In the United States, the SKNJCT-003 trial has already enrolled more than 75% of its planned 90 participants and continues to show encouraging progress following a positively trending interim analysis earlier this year. At the same time, a second Phase 2 study (SKNJCT-004) is underway across six clinical sites in the United Arab Emirates, including Cleveland Clinic Abu Dhabi and Sheikh Shakbout Medical City. The company expects to complete patient recruitment for SKNJCT-003 before the end of Q4 2025 and to request an End-of-Phase 2 meeting with the FDA in Q1 2026. Medicus estimates that the market potential for non-invasive BCC treatments could approach $2B annually. Executive Chairman and CEO Dr. Raza Bokhari stated that the FDA's feedback "marks an important step toward establishing SkinJect as a potential first-in-market, non-invasive therapy for BCC," adding that confidence continues to grow as development progresses. (MDCX) Broadens Late-Stage Pipeline With Antev Acquisition

Medicus Pharma (NASDAQ: MDCX) has completed its acquisition of Antev Limited, gaining control of Teverelix trifluoroacetate, a next-generation GnRH antagonist in late-stage development for both acute urinary retention (AURr) and high cardiovascular-risk prostate cancer. The move broadens (MDCX)'s clinical scope into two therapeutic areas with a combined $6B market potential.

Teverelix is designed for dual use: in AURr, a condition with high recurrence rates, it aims to become the first product to prevent relapse, supported by an FDA-cleared Phase 2b study of 390 patients. In prostate cancer patients with elevated cardiovascular risk, it is being evaluated in another FDA-cleared Phase 2b trial as a potentially safer alternative to conventional therapies. The acquisition also adds leadership depth, with veteran pharma executive Patrick J. Mahaffy joining the board. Together, the expanded pipeline and strengthened leadership put (MDCX) in position to reshape care across two areas of pressing medical need. Turning Point Ahead as Momentum Builds for (MDCX)

With late-stage programs advancing, growing clinical progress, and key regulatory steps approaching, (MDCX) is entering a pivotal phase. Momentum potential across its strategy and leadership has placed it firmly on our radar—and seven factors now stand out heading into this morning's session.

7 Reasons Why (MDCX) Is Topping Our Watchlist This Morning

—Tuesday, October 21, 2025

1. Analyst Targets: recent coverage on (MDCX) includes targets reaching up to $27, which suggests 980% upside potential.

2. Recent Momentum: after an approximate 70% move in just three weeks, (MDCX) could have the potential to attract broader support among those tracking biotech profiles.

3. Tiny Float: with fewer than 5M shares available to the public, (MDCX)'s tiny float could have the potential for big moves if demand begins to shift.

4. Antev Acquisition Expands Therapeutic Scope: the purchase of Antev Limited adds late-stage assets like Teverelix, expanding (MDCX)'s therapeutic reach into urology and oncology. 5. Global Phase 2 Trials Drive Clinical Momentum: with two Phase 2 studies active across the U.S. and UAE, (MDCX) continues to advance clinical validation on an international scale. 6. FDA Alignment Strengthens Development Path: the FDA's positive feedback on the SkinJect program reinforces (MDCX)'s advancement along a streamlined 505(b)(2) pathway with defined next steps. 7. Strong Insider Ownership: with over 50% insider ownership, leadership at (MDCX) remains closely tied to the company's performance and long-term vision. All seven factors point to one conclusion—(MDCX) is entering a decisive stretch. With multiple potential catalysts aligning across its pipeline, this morning stands out as a moment to keep (MDCX) at the top of your radar. Take A Look At (MDCX) Before The Bell Rings…

With the potential for momentum building, analyst coverage, and the ultra-small float, Medicus Pharma Ltd. (NASDAQ: MDCX) stands out as one of the more intriguing names heading into Friday. Its small float of fewer than 5M shares, combined with more than 50% insider ownership, creates a setup that remains closely aligned with leadership's direction. Its recent approximate 70% move in just three weeks has put (MDCX) on our radar, while an analyst target as high as $27 suggests over 1,000% upside potential.

At the same time, the FDA's positive feedback on SkinJect, coupled with two active Phase 2 trials across the U.S. and UAE, reinforces real clinical progress. And with the addition of Antev Limited and its late-stage programs, (MDCX) continues to broaden its reach across multiple therapeutic fronts. We're tracking (MDCX) right now as we head into Tuesday's session. There's less than 10 minutes to go. Pull up (MDCX) before the bell rings. Also, keep a lookout for my next update, it could be hitting any moment. Sincerely, Alex Ramsay

Co-Founder / Managing Editor Krypton Street Newsletter

|