*Disseminated on Behalf of Medicus Pharma Ltd.

Krypton Street Announces Coverage On Medicus Pharma (NASDAQ: MDCX) Starting Tomorrow Morning—Monday, September 22, 2025 (MDCX) Comes Backed By Several Potential Catalysts—And Here's What

We Can Tell You So Far…

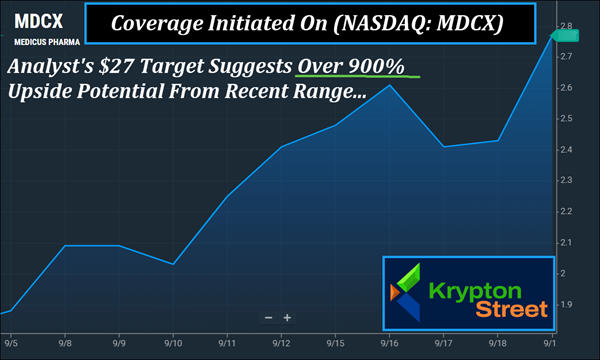

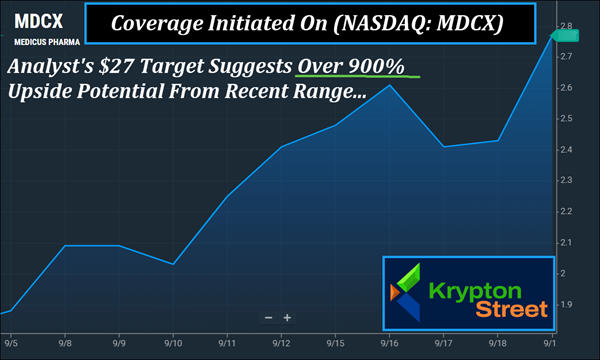

Recent Momentum: (MDCX) Has Climbed About 50% In Three Weeks And

Now Trends Above Its 5, 20, And 50-Day Moving Averages.

Analyst Coverage: Targets As High As $27 Have Been Reported For (MDCX), Which Suggest Over 900% Upside Potential From Current Levels.

Strong Insider Ownership: More Than 70% Of (MDCX) Shares Are Held By Insiders, Aligning Leadership Closely With Company Direction.

Small Float: With A Small Float Of Less Than 3M Shares, (MDCX) Could

Witness The Potential For Big Moves If Demand Starts To Shift. Put (MDCX) On Your Screen Before Tomorrow Morning…

September 21, 2025

Monday's Watchlist | (NASDAQ: MDCX) Just Hit Tomorrow's Radar—Here's Why Dear Reader, Breakthroughs in medicine rarely begin in the spotlight — they usually build quietly until the data, the pipeline, and the market converge. Right now, one emerging biotech is advancing programs aimed at two conditions where new solutions are urgently needed: prostate cancer and non-melanoma skin cancer. That company is Medicus Pharma (NASDAQ: MDCX) — and its recent progress is starting to capture attention from those watching the next wave of catalysts, ourselves included. Over the past three weeks, (MDCX) has made an approximate 50% move. The chart now shows the company trending above several key technical levels — including its 5, 20, and 50-day moving averages. Together, these signals suggest the potential for continued momentum. And following its recent acquisition, (MDCX) will be topping our watchlist tomorrow morning—Monday, September 22, 2025. But keep in mind, (MDCX) has an ultra-small float, with fewer than 3 Mln shares listed as available to the public according to FinViz. Insider ownership is also reported at over 75%, a level that could reflect a management team's confidence in the company's direction. Recent Analyst Target Suggests Over 900% Upside Potential

Multiple news sites and market portals, including Benzinga, MarketWatch, and TipRanks, have reported that D. Boral Capital analyst Jason Kolbert recently set a $27 target on (MDCX), which suggests over 900% upside potential from its recent $2.50 range. That's not the only target we're tracking. In coverage released Thursday, Maxim Group analyst Jason McCarthy reiterated a $20 target for (MDCX) — pointing to significant upside from where shares recently traded. His outlook is supported by a pipeline that continues to advance in areas where new treatment options are urgently needed. At the forefront is a program in development that could redefine how prostate cancer is addressed. Antev Deal Completed: (MDCX) Strengthens Both Pipeline And Leadership

Medicus Pharma (NASDAQ: MDCX) has completed its acquisition of Antev Limited, securing control of Teverelix trifluoroacetate, a next-generation GnRH antagonist in late-stage development for both acute urinary retention (AURr) and high cardiovascular-risk prostate cancer. The move expands (MDCX)'s clinical reach into two therapeutic areas with a combined $6B market potential.

The addition of Teverelix significantly broadens Medicus' clinical scope, bringing the company into two therapeutic areas that represent a large and expanding healthcare market. Teverelix stands out for its dual application. In acute urinary retention, a condition affecting a large number of cases in the United States each year — with roughly 30% experiencing recurrence within six months — the compound aims to become the first product designed specifically to prevent relapse.

This effort is supported by an FDA-cleared Phase 2b study enrolling 390 patients. In advanced prostate cancer patients with elevated cardiovascular risk, Teverelix is being evaluated in a separate FDA-cleared Phase 2b trial as a potentially safer alternative to conventional androgen deprivation therapies. The acquisition also strengthens leadership at (MDCX. Patrick J. Mahaffy, a veteran pharma executive and former CEO of Clovis Oncology and Pharmion, has joined the company's board of directors. With this transaction, (MDCX has not only expanded its pipeline but also added a late-stage asset that could reshape standards of care across two areas of significant unmet need. (MDCX) Expands Clinical Footprint With SkinJect Trials In U.S. And UAE

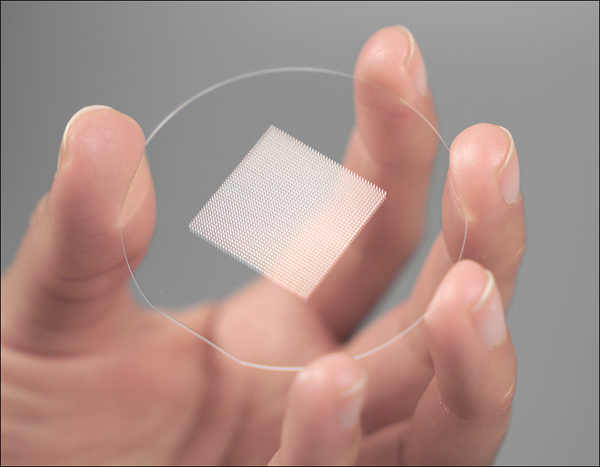

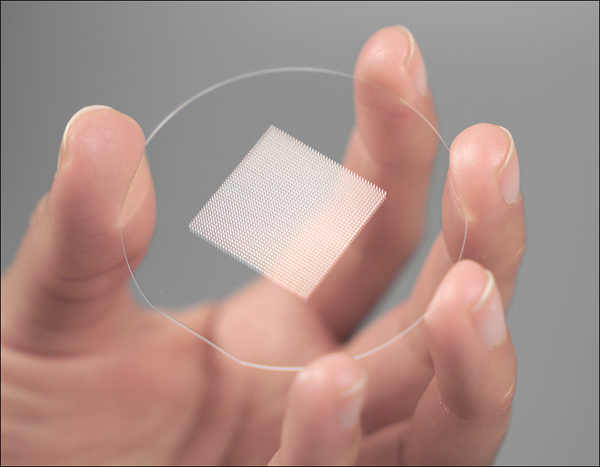

Alongside its urology pipeline, (MDCX) controls SkinJect, a dissolvable microneedle patch designed for non-melanoma skin cancers, particularly Basal Cell Carcinoma (BCC). Unlike surgery, which often leaves scars and requires extended recovery, SkinJect delivers doxorubicin directly into the lesion through microneedle arrays with the goal of eliminating tumor cells while also triggering an immune response that may reduce recurrence. BCC is one of the most common cancers diagnosed in the United States each year, and with traditional treatments often invasive and burdensome, the need for less disruptive alternatives continues to grow. On September 8, 2025, (MDCX) announced the launch of its SKNJCT-004 Phase 2 clinical study in the United Arab Emirates, with patient recruitment now underway at Cleveland Clinic Abu Dhabi. The trial will enroll 36 participants across multiple UAE sites, including Sheikh Shakbout Medical City, Burjeel Medical City, Rashid Hospital, Clemenceau Medical Center, and American Hospital of Dubai. It is structured as a randomized, double-blind, placebo-controlled study designed to evaluate two dose levels of SkinJect's patch. This progress builds on the company's SKNJCT-003 Phase 2 study in the United States, which has already randomized more than 75% of its expanded 90-patient enrollment after a positively trending interim analysis earlier this year. Together, the U.S. and UAE trials underscore (MDCX)'s commitment to advancing SkinJect as a potential first-in-class, non-invasive therapy for skin cancer — a condition where clinical demand continues to rise across both domestic and international healthcare systems. Why Medicus Pharma (NASDAQ: MDCX) Stands Out

With two late-stage clinical programs now in motion, expanding partnerships, and a lean structure compared to its potential, (MDCX) has earned a spot on our radar. The company is approaching a critical stretch, with progress in the clinic and key regulatory steps expected ahead. For those tracking biotech catalysts, (MDCX) is increasingly difficult to ignore. Momentum is stacking across its pipeline and leadership, setting it apart from sector peers. When we lined up the numbers, the strategy, and the science, seven clear factors emerged that show why tomorrow morning could be a turning point. Here's 7 Reasons Why (MDCX) Will Be Topping Our Watchlist

Tomorrow Morning—Monday, September 22, 2025 1. Recent Momentum: Over the past three weeks, (MDCX) has moved approximately 50% and is now trending above its 5, 20, and 50-day moving averages.

2. Analyst Coverage: Recent coverage on (MDCX) has targets as high as $27, which suggests over 900% upside potential from its current range. 3. Strong Insider Ownership: With insider ownership above 70%, leadership at (MDCX) is deeply tied to the company's direction and progress. 4. Small Float: Fewer than 3M shares of (MDCX) are listed as available to the public, creating conditions where shifts in demand can have amplified effects. 5. Pipeline Expansion: Through its completed Antev acquisition, (MDCX) now controls Teverelix, a Phase 2 asset advancing in both acute urinary retention and high cardiovascular-risk prostate cancer. 6. Global Trials: Phase 2 clinical studies for SkinJect are running in parallel across the U.S. and UAE, positioning (MDCX) on an international development path. 7. Leadership Depth: The addition of Patrick J. Mahaffy, a seasoned executive with prior CEO roles in oncology, strengthens the strategic leadership of (MDCX).

Taken together, these seven factors paint a clear picture of why (MDCX) is stepping into focus right now. And with several potential catalysts stacking across its pipeline, tomorrow morning could prove to be a key moment to keep this name on the radar. Put (MDCX) On Your Screen Before Tomorrow Morning…

With momentum already building — an approximate 50% move in recent weeks and a clear trend above key technical levels — (MDCX) has captured our attention. Analyst coverage continues to point toward ambitious targets, while insider ownership above 70% could be a sign the leadership team is firmly aligned with its direction. Add in an ultra-small float, the completed Antev acquisition bringing Teverelix into late-stage development, and global SkinJect trials progressing in both the U.S. and UAE, and it's clear this is a company stepping into a pivotal stage. With the added weight of seasoned leadership now guiding the process, (MDCX) has more than one reason to stay in sharp focus. We will have all eyes on (MDCX) tomorrow morning. Take a look at (MDCX) before you call it a night. Also, keep a lookout for my morning update. Have a good night. Sincerely, Alex Ramsay

Co-Founder / Managing Editor

Krypton Street Newsletter |