AI Chip Stocks' Meltdown Is an Excellent Buying Opportunity | As I write Friday morning, the Nasdaq has slipped more than 3% on the week. It's on pace for its worst weekly performance since April.

The pain began with the soft June inflation report that served as the green light for a rotation of historic proportion out of large-cap tech stocks into small-cap stocks. It then picked up steam earlier this week when reports leaked that the U.S. government is considering even stricter controls on tech exports to China.

While this is rattling many tech investors, our expert Luke Lango urges a different reaction: "This is a time to be greedy when others are fearful."

Today, Luke recaps this week's tech wreck and then makes the case for why this is an opportunity to embrace, not a meltdown to flee.

We'll find out the trigger he's watching that will cause him to be an "aggressive buyer on a rebound in the best AI chip stocks."

I'll let Luke take it from here.

Have a wonderful weekend,

Jeff Remsburg |

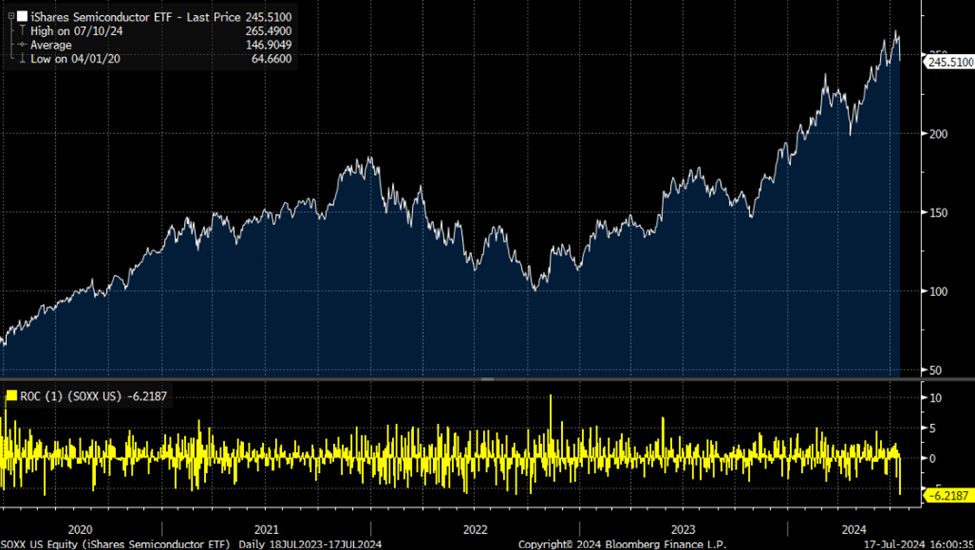

There’s no sugarcoating it. AI chip stocks got obliterated [last Wednesday]. We saw hot picks like ASML (ASML), Nova (NVMI), Camtek (CAMT), Celestica (CLS), Applied Materials (AMAT), Advanced Micro Devices (AMD) and Lam Research (LRCX) all drop nearly 10% or more. But the evidence suggests that this is a time to be greedy when others are fearful… Broadly speaking, [last Wednesday] was the worst day for AI chip stocks since the height of the COVID-19 pandemic. The iShares Semiconductor ETF (SOXX) dropped more than 7%, matching its worst single-day drop since the depths of the COVID crash.  The culprit behind this decline – geopolitics. | ADVERTISEMENT  According to 30-year Silicon Valley and Wall Street veteran, Eric Fry…

A man who picked 41 plays that jumped 1,000%+...

This mind-blowing new technology could be bigger than the iPhone.

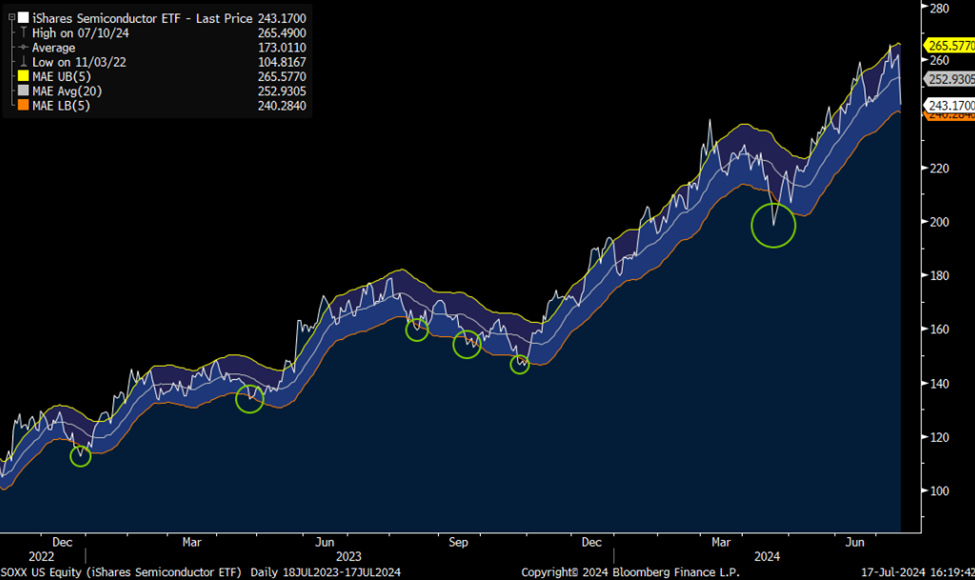

And it could make a lot of people wealthy in the coming months and years. | Why AI Chip Stocks Plummeted This Week Last week, reports leaked suggesting that the Biden administration is looking to impose even stricter controls on sales of semiconductors and related equipment to China. Meanwhile, former President Donald Trump sounded negative in his comments about Taiwan (the semiconductor manufacturing capital of the world). Investors’ net takeaway was that no matter who wins the White House in November, there will likely be increased scrutiny on the exchange of AI products and equipment between the U.S. and Asia. But this scrutiny is nothing new. Ever since 2016, when Trump was first elected, the U.S. has been engaged in an on-again, off-again trade war with China. But it seems this trade war – under both Trump and Biden – has been 95% talk and 5% action. And the little action imposed has not materially impacted the revenues, profits or stock prices of chipmakers. After all, even after yesterday’s drop, the SOXX ETF is still up almost 50% over the past year. That’s why we think the market is grossly overreacting to a bunch of political “hot air” that will amount to a nothing-burger for AI chipmakers. Much more importantly, we expect these chipmakers to report strong quarterly earnings over the next few months on the back of continued AI momentum, the likes of which reaffirms their fundamental strength. And with that validation, AI chip stocks should bounce back strongly. The Technicals Support the Bull Thesis Here, Too The SOXX ETF is on the cusp of dropping outside the lower band of its 20-day Moving Average Envelope. Essentially, that means the ETF is about to fall 5% below its 20-day moving average. Ever since ChatGPT’s launch in November 2022, similar drops below the lower band of SOXX’s 20-day Moving Average Envelope have led to strong short-term rebound rallies.  Therefore, we are directionally bullish on a rebound in AI chip stocks after Wednesday's bloodbath. | ADVERTISEMENT  The last two times this election pattern played out…

Legendary trader Tom Gentile gave his readers a chance to double their money or more a total of 102 times.

Click here to see the details because you could be the biggest winner of this upcoming presidential election…

Regardless of who wins the election.

Click here. | Meanwhile, Remember that Companies Continue to Spend an Arm and a Leg on AI Wall Street firm Cantor Fitzgerald said in a research note recently that: “We continue to believe that AI-leveraged names are still the most attractive to own heading into earnings.” Deutsche Bank also said recently that investors remain “generally optimistic on the current AI megatrend ‘winners’,” mostly because of sustained earnings strength. TD Cowen just said that there are no signs of generative AI demand abating in the near-term, specifically referencing the fact that Broadcom (AVGO) just hiked its AI target for the full year. And Wedbush just said that: “In a nutshell, our tech field checks globally show cloud deployments and enterprise AI spending is tracking nicely ahead of Street expectations which bodes well for Big Tech names into this key earnings season.” Broadly, the AI theme remains hot. It will soon couple with rate cuts to provide a big jolt to earnings, which should in turn provide a big jolt for the stock market. The Final Word on the Bull Thesis for AI Chip Stocks Given our directional bullishness noted above, does that mean that the time to buy is right now? Not necessarily. We’re urging caution until strong technical support arrives. But… once that happens… we would be aggressive buyers on a rebound in the best AI chip stocks. Which stocks are we talking about? Learn about a few of our favorites right now. Sincerely,

Luke Lango

Senior Analyst, InvestorPlace |