*Sponsored

Market Crux Initiates Coverage On Moleculin Biotech, Inc. (NASDAQ: MBRX)

Starting This Morning—Tuesday September 8, 2025

(MBRX) Comes Backed By Several Potential Catalysts Including:

Analyst Targets: Roth MKM Set A $13 Target On (MBRX), Which Suggests An Upside Potential Of Over 3,000% From This Week's Range.

Recent Momentum: (MBRX)'s Chart Showcases An Approximate 280% Move

In Under One Month.

Market Growth: (MBRX) Is Aligned With Oncology Markets Projected To Expand From $250B In 2025 To Nearly $668B Within The Next Decade.

Pull Up (MBRX) While It's Still Early…

September 9, 2025

Early Session Watch | (NASDAQ: MBRX) Still At The Top Of Our Radar—Here's Why Dear Reader, Right now, early in the session, Moleculin Biotech, Inc. (NASDAQ: MBRX) is still at the very top of our radar. Coverage has rolled in, analyst targets are stacking up, and the setup continues to build in real time. At the moment, it's becoming one of the most closely watched stories on our screen. This late-stage pharma profile is stepping into the spotlight this morning with global trials, breakthrough preclinical findings, and a lead therapy that's already drawing attention from top researchers. The setup forming right now has all the elements of a major story in the making. Adding fuel to the fire, analysts have rolled out coverage with targets suggesting anywhere from 900% to more than 3,000% upside from this week's $0.38 range.

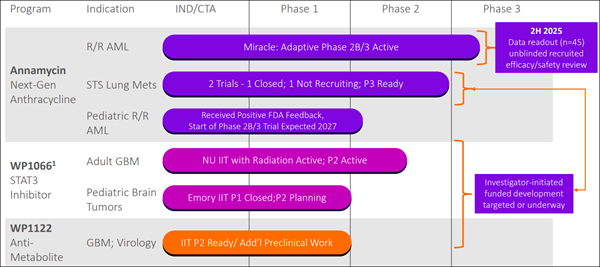

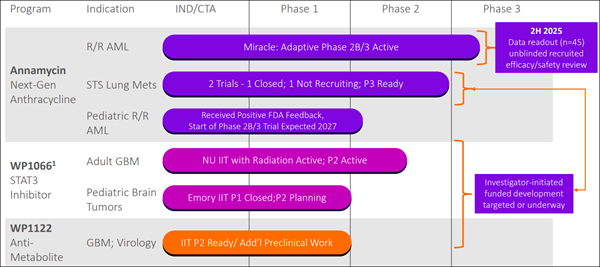

(MBRX) has already demonstrated its potential for momentum, moving approximately 280% from $0.25 on June 20 to $0.96 on July 18. Analysts have taken notice, with Jason McCarthy at Maxim Group and Sara Nik at H.C. Wainwright each set a $4 target — which suggests more than 900% upside potential from this week's $0.38 range — while Jonathan Aschoff at Roth MKM set a $13 target, which suggests over 3,300% potential upside. Adding to the setup, (MBRX) is now pressing against key technical levels. Late yesterday, it tapped $0.39, moving above its 5-day average of 0.3795. With its 20-day at 0.5314, 50-day at 0.5699, and 100-day at 0.7047, the chart is starting to show the kind of strength that could draw attention. It's not hard to see why interest could be building here. And the technical picture isn't the only factor worth watching. The broader oncology sector—estimated at $250B in 2025—is projected to grow to nearly $668B by 2034. In the U.S. alone, oncology is set to climb from $90B in 2025 to over $220B by 2034. Against this backdrop, the AML market is expected to expand from $1.74B in 2025 to nearly $2.92B by 2032, while the CAR T-cell therapy segment could grow from $12.9B in 2025 to about $128B by 2034. With these markets accelerating, (MBRX) has aligned its pipeline toward some of the most urgent and underserved areas. The company has been steadily advancing through the clinic, and 2025 is shaping up as a critical year. With multiple late-stage trials underway, it is pursuing therapies designed for some of the toughest cancers and vi-rus-related illnesses—areas where conventional approaches often fall short. At the center of this progress is Annamycin, a next-generation therapy designed to do what older chemotherapy treatments often cannot: attack cancer effectively without the heart-damaging side effects that limit traditional anthracyclines. Why Annamycin Stands Out

Annamycin—recently given the non-proprietary name naxtarubicin—was engineered to overcome two of the biggest barriers in cancer treatment: - Resistance: Over time, many cancers adapt to therapy, reducing effectiveness. Annamycin was designed to bypass these resistance pathways.

- Heart Safety: Current anthracyclines carry a dose-related risk of heart failure, forcing strict treatment limits. In trials, Annamycin has shown no evidence of this toxicity—even in patients who received multiple cycles at levels above the FDA's lifetime limit.

This combination—strong anti-cancer activity paired with a safety profile that may support repeated use—sets Annamycin apart from conventional therapies. The Lead Program: The MIRACLE Trial

The most closely watched program in Moleculin's pipeline is the MIRACLE trial, a global Phase 3 study evaluating Annamycin in combination with cytarabine—together known as AnnAraC—for patients with relapsed or refractory acute myeloid leukemia (AML). AML is an aggressive cancer, and once patients relapse, current care options remain extremely limited. That is why the progress of this trial carries such weight. Earlier studies combining Annamycin with cytarabine produced remission rates that went beyond expectations, even in patients who had already cycled through multiple lines of therapy. Building on that foundation, the FDA has provided direct guidance on the design of the MIRACLE study. The first readout of patient data is expected before the end of 2025, with additional updates anticipated in the first half of 2026. This pivotal trial could help reshape expectations for AML treatment if results continue to hold. Beyond AML: Expanding the Reach of Annamycin

Annamycin's potential reach goes well beyond AML: - Soft Tissue Sarcoma (STS) Lung Metastases: In a Phase 1B/2 study, patients who had already failed multiple prior treatments lived a median of 13.5 months after receiving Annamycin. That outcome rivaled or exceeded results typically seen in patients treated much earlier in their care cycle.

- Liver Cancers: Preclinical data presented in August 2025 showed powerful activity against primary liver cancer, colorectal cancer that spread to the liver, and pancreatic cancer with liver involvement. Importantly, Annamycin concentrated in the liver, lungs, spleen, and pancreas—suggesting a natural targeting effect.

Together, these findings highlight a broader therapeutic reach across multiple cancer types. A Pipeline Beyond Annamycin

(MBRX) is advancing more than a single therapy. Its pipeline includes: - WP1066: An immune/transcription modulator designed to shut down cancer-driving proteins like p-STAT3 while boosting the body's natural immune response. Trials are underway in glioblastoma and pediatric brain tumors.

- WP1122: A compound designed to block cancer and vi-ruses from accessing the glucose they need to survive. Preclinical work is being led at Emory University.

Many of these programs are supported by investigator-led studies, allowing (MBRX) to broaden its therapeutic pipeline while conserving resources. Recent Momentum: 2025 Highlights

The past year has brought several key developments: - Global Expansion: The MIRACLE trial has now expanded into the U.S., Europe, Georgia, and Ukraine, with more than 20 additional sites expected by the end of Q3 2025.

- Patent Strengthening: Multiple new patents have extended protection for Annamycin into 2040.

- Preclinical Breakthroughs: Liver cancer data presented at MD Anderson further validated Annamycin's unique profile.

- Ca-sh Position: As of June 30, 2025, (MBRX) held $7.6M in ca-sh, supporting operations into the fourth quarter while continuing to pursue strategic partnerships and externally funded programs.

With so much lining up at once, (MBRX) is no longer just another late-stage pharma quietly moving through trials—it's quickly becoming a name that could command far more attention. The combination of recent moves, analyst coverage, and expanding clinical milestones is creating the type of setup that demands a closer look. 7 Reasons Why (MBRX) Is Topping Our Watchlist This Morning

—Tuesday, September 9, 2025

1. Recent Momentum: (MBRX) recently moved approximately 280% from $0.25 to $.96 in less than a month, highlighting its potential for momentum. 2. Analyst Targets: Coverage on (MBRX) includes $4 targets from Maxim Group and H.C. Wainwright, and a $13 target from Roth MKM—which suggests 900% to over 3,000% upside potential. 3. Market Growth: (MBRX) is aligned with oncology markets projected to expand from roughly $250B in 2025 to nearly $668B by 2034, with AML and CAR T-cell segments also showing sharp growth. 4. Worldwide Enrollment: The Phase 3 MIRACLE study puts (MBRX) on an international stage with enrollment across the U.S., Europe, Georgia, and Ukraine. 5. FDA Spotlight: In studies, Annamycin from (MBRX) has shown no evidence of heart damage even at levels above the FDA's lifetime limit for anthracyclines. 6. Pipeline In Focus: Beyond Annamycin, (MBRX) is advancing additional compounds such as WP1066 for brain tumors and WP1122 for oncology and vi-ral indications. 7. Stronger IP Foundation: With new protections for Annamycin extended into 2040, (MBRX) has strengthened its intellectual property foundation for long-term development. Momentum potential like this doesn't stay under the radar for long, and (MBRX) is now stepping into a spotlight that continues to grow brighter by the day. The alignment of market growth, analyst coverage, and pivotal trial progress makes this a setup worth paying very close attention to. Pull Up (MBRX) While It's Still Early…

The story around Moleculin Biotech, Inc. (NASDAQ: MBRX) is hard to ignore right now. In just weeks, it moved approximately 192% off its June levels, underscoring the kind of momentum that gets noticed. Analysts are already weighing in with targets that stretch from $4 to $13, which suggests over 900% to 3,000% upside potential from its recent range. Layer on top of that, the sheer scale of the oncology markets—projected to more than double over the next decade—and it's clear that (MBRX) is advancing within one of the fastest-growing areas in healthcare. Its Phase 3 MIRACLE trial is already enrolling patients across multiple countries, its lead therapy has shown no evidence of heart toxicity even beyond standard limits, and additional pipeline compounds are broadening its reach well past a single indication. With patents for Annamycin now extended into 2040, the foundation for long-term development continues to solidify. Watch it live — coverage has now landed on (MBRX), putting it squarely at the top of our early radar. Take a look at (MBRX) while it's still early. (MBRX) is becoming one of the most closely watched stories on our screen. Also—keep an eye out for my next update—it could be hitting any moment. Sincerely, Gary Silver

Managing Editor, Market Crux

|